Hedge Fund AI Market Expected to Hit $1.17 Billion Worldwide by 2025: Strategic Growth in the U.S., U.K., and Singapore

Hedge Fund AI Market forecast: $1.17 billion worldwide by 2025, with strategic growth opportunities emerging in the U.S., U.K., and Singapore

- Last Updated:

Hedge Fund AI Market Q1 and Q2 of 2025 Forecast and Regional Insights

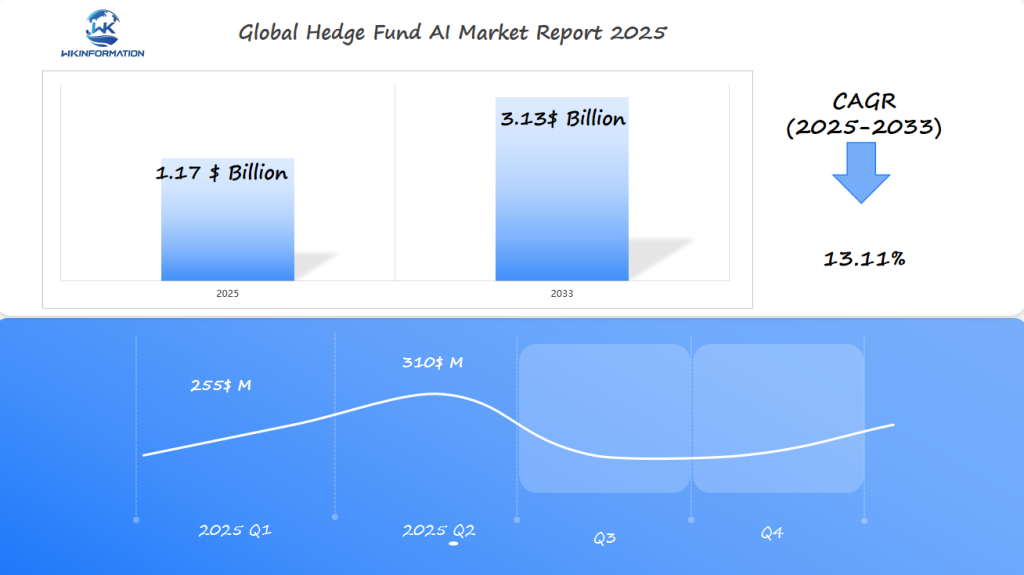

The Hedge Fund AI market is projected to reach $1.17 billion in 2025, growing at a robust CAGR of 13.11% through 2033. Market activity in early 2025 is expected to be uneven, with Q1 revenues estimated at $255 million, followed by a rise to $310 million in Q2. This trend reflects increasing adoption of AI-driven investment strategies amid evolving financial markets and regulatory environments.

Key Regional Insights

- The U.S. dominates the landscape, driven by its mature hedge fund ecosystem and advanced AI capabilities.

- The U.K. contributes significantly with its established financial services sector and innovation hubs.

- Singapore serves as a strategic gateway for Asia-Pacific investments.

These countries are key to understanding competitive dynamics and technological advancements in financial AI applications.

Upstream and Downstream Industry Chain Analysis of Hedge Fund AI

Upstream:

-

Data Providers

-

Types: Financial market data, alternative data (e.g., satellite imagery, social media sentiment, ESG metrics), macroeconomic indicators.

-

Key Players: Bloomberg, Refinitiv, Quandl, S&P Global, FactSet, RavenPack.

-

-

AI and Machine Learning Technology Providers

-

Types: AI frameworks, machine learning platforms, NLP engines, cloud computing infrastructure.

-

Key Players: Google Cloud (Vertex AI), AWS (SageMaker), Microsoft Azure, NVIDIA (GPU hardware), OpenAI, Databricks.

-

-

Talent and Human Capital

-

Types: Quantitative researchers, data scientists, software engineers, financial modelers.

-

Sources: Top universities, AI research labs, specialized recruitment firms.

-

-

Software and Platform Vendors

-

Types: Portfolio management systems, backtesting platforms, data engineering pipelines.

-

Key Players: Aladdin by BlackRock, QuantConnect, Backtrader, Kx Systems, MATLAB.

-

Downstream:

-

Hedge Funds and Investment Firms

-

Usage: Signal generation, risk modeling, algorithmic trading, portfolio optimization.

-

Examples: Two Sigma, Renaissance Technologies, Citadel, DE Shaw, AQR.

-

-

Institutional Investors

-

Types: Pension funds, endowments, sovereign wealth funds allocating capital to AI-powered hedge funds.

-

Role: Drive demand for performance and transparency, influencing AI model development priorities.

-

-

Regulators and Compliance Systems

-

Needs: Explainability, transparency, audit trails for AI-based decisions.

-

Institutions: SEC (U.S.), FCA (UK), ESMA (EU).

-

-

Retail Investment Channels (Emerging)

-

Through: Robo-advisors or hedge fund-linked financial products integrating AI insights indirectly.

-

Emerging Trends Shaping Hedge Fund AI Market Trajectory

The Hedge Fund AI Market is undergoing a significant transformation due to various emerging trends. Artificial intelligence in finance is becoming increasingly common, fueling growth and innovation in the industry.

Technological Advancements in AI

Technological advancements in AI are a key driver of the growth in the Hedge Fund AI Market. Machine learning algorithms are being increasingly used to analyze vast amounts of data, enabling hedge funds to make more informed investment decisions.

The use of AI in hedge funds is also improving risk management practices, allowing for more sophisticated analysis and mitigation of potential risks.

Impact of Machine Learning on Hedge Fund Strategies

Machine learning is having a profound impact on hedge fund strategies, enabling funds to analyze complex data sets and identify patterns that may not be apparent through traditional analysis.

This is leading to more effective investment decisions and improved risk management, driving growth in the Hedge Fund AI Market.

As machine learning technology continues to evolve, it is expected to play an increasingly important role in shaping the future of the hedge fund industry.

Market Restrictions and Regulatory Challenges in Hedge Fund AI Sector

The Hedge Fund AI Market is constantly changing, but it has to deal with strict rules that are different in each area. This variety in regulations creates major difficulties for hedge funds trying to incorporate AI solutions into their operations.

Regulatory Frameworks Affecting Hedge Fund AI

The regulatory landscape for Hedge Fund AI is complex, with multiple frameworks governing the use of AI in financial services. These frameworks are designed to protect investors, maintain market integrity, and prevent financial crimes.

Key regulatory considerations include:

- Data protection and privacy laws

- Anti-money laundering (AML) and know-your-customer (KYC) regulations

- Market manipulation and insider trading laws

- Guidelines on the use of AI and machine learning in investment decisions

Compliance Challenges

Compliance with these regulatory frameworks is a significant challenge for hedge funds. The use of AI adds another layer of complexity, as hedge funds must ensure that their AI systems are transparent, explainable, and compliant with relevant regulations.

A key challenge in compliance is the lack of standardization in AI regulations across different jurisdictions. Hedge funds operating globally must navigate these differences to ensure compliance.

| Regulatory Aspect | Description | Impact on Hedge Fund AI |

| Data Protection | Laws governing the collection, storage, and use of personal data | Requires hedge funds to ensure AI systems comply with data protection regulations |

| AML/KYC | Regulations to prevent money laundering and verify customer identities | AI systems must be designed to support AML/KYC compliance |

| Market Integrity | Laws preventing market manipulation and insider trading | AI systems must be monitored to prevent unintended market impact |

The Hedge Fund AI Sector faces significant regulatory challenges that impact its growth and adoption. Understanding and complying with these regulations is crucial for hedge funds to leverage AI effectively.

Geopolitical Factors Impacting Hedge Fund AI Industry

Understanding geopolitical factors is essential for navigating the complexities of the Hedge Fund AI market. Geopolitical instability can lead to market volatility, affecting hedge fund strategies and the adoption of AI technologies.

Global Economic Trends

Global economic trends significantly influence the Hedge Fund AI industry. Shifts in economic power, changes in monetary policies, and fluctuations in commodity prices can all impact market dynamics. For instance, a rise in protectionist policies can lead to increased market volatility, prompting hedge funds to adapt their AI-driven strategies to mitigate risks.

Trade Policies and Their Impact

Trade policies are a critical component of geopolitical factors affecting the Hedge Fund AI industry. Changes in tariffs, trade agreements, and export controls can have far-reaching implications for global markets. Hedge funds must stay abreast of these changes to adjust their investment strategies accordingly. For example, the imposition of tariffs can lead to increased costs for certain commodities, affecting the profitability of investments in those areas.

The impact of trade policies on hedge fund strategies can be significant. AI technologies can help analyze the potential effects of trade policy changes, enabling hedge funds to make more informed investment decisions. By leveraging AI-driven insights, hedge funds can better navigate the complexities of global trade and optimize their portfolios.

In conclusion, geopolitical factors, including global economic trends and trade policies, play a crucial role in shaping the Hedge Fund AI industry. By understanding these factors and leveraging AI technologies, hedge funds can develop more effective strategies to navigate the complex financial landscape.

Detailed Type Segmentation of Hedge Fund AI Solutions

AI solutions in the hedge fund industry are diverse, ranging from natural language processing to complex machine learning algorithms. This diversity allows hedge funds to leverage different technologies to enhance their investment strategies and operational efficiency.

Types of AI Solutions Used

The hedge fund AI market is characterized by the use of various AI technologies. Machine learning algorithms are widely used for predictive modeling and pattern recognition in financial data. Natural Language Processing (NLP) is utilized for analyzing financial news, reports, and social media to gauge market sentiment.

Predictive analytics is another crucial AI solution that enables hedge funds to forecast market trends and make informed investment decisions. These technologies are transforming the hedge fund industry by providing sophisticated tools for data analysis and investment strategy development.

Hedge funds employ AI in various strategies, including quantitative trading, risk management, and portfolio optimization. Quantitative trading involves using AI algorithms to analyze large datasets and identify profitable trades. AI is also used in risk management to predict potential risks and mitigate them.

- Quantitative trading strategies rely heavily on machine learning models to predict stock prices and optimize trading decisions.

- Risk management involves using AI to monitor and analyze potential risks, enabling hedge funds to take proactive measures.

- Portfolio optimization uses AI to analyze and adjust the portfolio composition to maximize returns and minimize risk.

Application Areas Driving Hedge Fund AI Market Expansion

Application areas such as risk management and investment strategies are fueling the Hedge Fund AI market expansion. The integration of AI in these areas is revolutionizing how hedge funds operate, making them more efficient and competitive.

Risk Management

Risk management is a critical application area for Hedge Fund AI. AI algorithms can analyze vast amounts of data to predict potential risks, enabling hedge funds to mitigate losses and maximize gains. AI-driven risk management systems can identify patterns that human analysts might miss, providing a more comprehensive risk assessment.

- Predictive analytics for risk forecasting

- Real-time monitoring of market conditions

- Automated risk reporting

Investment Strategies

AI is also transforming investment strategies in hedge funds. By analyzing market trends, news, and other data, AI can help hedge funds make informed investment decisions. AI-powered investment strategies can adapt to changing market conditions, optimizing portfolio performance.

- Data-driven investment decisions

- Personalized investment portfolios

- Continuous portfolio optimization

As AI technology continues to evolve, its applications in risk management and investment strategies are expected to expand, driving further growth in the Hedge Fund AI market.

Global Regional Insights into Hedge Fund AI Market Development

Regional insights into the Hedge Fund AI Market reveal diverse adoption rates and market dynamics. The development of the Hedge Fund AI Market varies across regions, influenced by factors such as the level of AI adoption, regulatory environments, and market dynamics.

Regional Adoption of AI

The adoption of AI in hedge funds is not uniform globally. Some regions are at the forefront of AI integration, while others are still in the early stages. North America, for instance, is a leader in AI adoption due to its mature financial infrastructure and favorable regulatory environment.

In contrast, regions like Europe are also making significant strides in AI adoption, driven by advancements in technology and increasing investment in AI research.

Market Dynamics Across Regions

Market dynamics play a crucial role in shaping the Hedge Fund AI Market across different regions. Factors such as competition, investor demand, and technological advancements contribute to the varying market dynamics.

- In Asia-Pacific, the market is driven by rapid technological advancements and increasing adoption of AI in emerging economies.

- In North America, the market is characterized by intense competition among key players and a strong focus on innovation.

Understanding these regional insights is crucial for stakeholders to identify growth opportunities and navigate the global market landscape effectively. By analyzing regional adoption rates and market dynamics, investors and fund managers can make informed decisions about their AI strategies.

The regional variations in the Hedge Fund AI Market highlight the importance of tailored strategies that cater to specific regional needs and market conditions.

U.S. Hedge Fund AI Market: Innovations and Growth Drivers

The U.S. Hedge Fund AI market is experiencing significant growth due to technological innovations and substantial investments in AI startups. The country’s strong financial sector, along with a supportive environment for AI development, makes it a leader in the Hedge Fund AI Market.

Technological Innovations

Technological advancements are a key driver of the U.S. Hedge Fund AI market. AI technologies are being increasingly adopted for their ability to analyze vast amounts of data, predict market trends, and optimize investment strategies. This has led to the development of sophisticated AI-driven hedge fund management systems.

The integration of machine learning algorithms and natural language processing is enhancing the capabilities of hedge funds to make informed investment decisions. These technologies enable hedge funds to stay ahead of market fluctuations and capitalize on emerging opportunities.

Investment in AI Startups

Investment in AI startups is another significant factor driving the growth of the U.S. Hedge Fund AI market. Venture capitalists and investors are recognizing the potential of AI technologies to revolutionize hedge fund management. As a result, there has been a notable increase in funding for AI startups focused on developing innovative solutions for the financial sector.

The influx of investment is not only fostering innovation but also creating new opportunities for hedge funds to leverage AI technologies. This trend is expected to continue, with the U.S. remaining at the forefront of the Hedge Fund AI market.

As the U.S. Hedge Fund AI market continues to evolve, it is likely that we will see further advancements in AI technologies and increased adoption across the hedge fund industry. The ongoing investment in AI startups and the development of new technologies will be crucial in driving this growth.

Current Status and Prospects of the U.K.'s Hedge Fund AI Market

The U.K.’s hedge fund AI market is navigating a complex regulatory landscape post-Brexit. Despite the challenges, the sector remains a significant contributor to the global hedge fund AI market.

Regulatory Environment

The regulatory environment in the U.K. is evolving, with new frameworks being introduced to govern the use of AI in financial services. This includes stricter guidelines on data protection and algorithmic transparency.

Key Regulatory Developments:

- Enhanced oversight on AI-driven trading systems

- Stricter data protection regulations

- Increased transparency requirements for AI decision-making processes

Adoption of AI in Hedge Funds

The adoption of AI in U.K. hedge funds is on the rise, driven by the need for more sophisticated risk management and investment strategies. AI technologies are being used to analyze vast amounts of data, predict market trends, and optimize portfolio performance.

The use of AI is also enhancing operational efficiency, allowing hedge funds to automate routine tasks and focus on higher-value activities.

| Trend | Description | Impact |

| Increased Use of Machine Learning | Hedge funds are leveraging machine learning algorithms to improve predictive analytics. | Enhanced investment decisions |

| Natural Language Processing | AI-powered NLP is being used to analyze financial news and reports. | Better market sentiment analysis |

| Automation of Trading Strategies | AI is automating trading strategies, enabling faster execution. | Improved operational efficiency |

The U.K.’s hedge fund AI market is expected to continue growing, driven by advancements in AI technology and increasing adoption across the financial sector.

Singapore’s Strategic Role in Hedge Fund AI Market

As a financial hub, Singapore is strategically positioned to leverage AI technologies in the hedge fund sector. The country’s strong financial infrastructure, coupled with government initiatives to promote AI adoption, makes it an attractive location for hedge funds looking to integrate AI solutions.

Financial Hub Status

Singapore’s status as a financial hub is a significant factor in its growing importance in the Hedge Fund AI Market. The city-state offers a conducive environment for financial institutions to operate, innovate, and adopt new technologies.

The financial hub status is supported by several key factors, including:

- A robust regulatory framework that encourages innovation while ensuring stability.

- A highly developed financial infrastructure, including data centers and cloud services.

- A talent pool skilled in both finance and technology.

Government Initiatives for AI

The government has launched several initiatives to support the development and adoption of AI in the financial sector, including:

- Funding for AI research and development projects.

- Programs to enhance AI talent and skills in the workforce.

- Regulatory sandbox environments to test AI innovations.

Singapore Hedge Fund AI Market

These government initiatives, combined with Singapore’s financial hub status, make it an ideal location for hedge funds to adopt and leverage AI technologies. The strategic role of Singapore in the Hedge Fund AI Market is expected to continue growing, driven by both local and international investments.

Forecasting Future Developments and Market Opportunities

Emerging trends and technological innovations are set to drive the Hedge Fund AI Market forward, presenting new opportunities and challenges. The integration of advanced AI solutions is expected to improve decision-making processes, risk management, and overall operational efficiency in hedge funds.

Emerging Trends

Several emerging trends are shaping the future of the Hedge Fund AI Market. These include:

- The increasing adoption of machine learning algorithms and natural language processing to analyze vast amounts of data and make informed investment decisions.

- The growing use of predictive analytics, enabling hedge funds to forecast market trends and adjust their strategies accordingly.

- The rising significance of alternative data sources, with hedge funds leveraging data from social media, news articles, and other unconventional sources to gain a competitive edge.

This trend is expected to continue, with more sophisticated data analysis tools being developed to handle the complexities of alternative data.

Potential Challenges

Despite the promising outlook, the Hedge Fund AI Market faces several potential challenges:

| Challenge | Description | Potential Impact |

| Regulatory Hurdles | Difficulty in complying with evolving regulatory requirements | High |

| Market Volatility | Unpredictability in financial markets affecting AI model accuracy | Medium |

| Technological Risks | Risks associated with AI model failures or cyber-attacks | High |

Regulatory hurdles are a significant concern as governments and financial regulatory bodies grapple with how to oversee the use of AI in financial markets. Ensuring compliance with existing regulations and adapting to new regulatory requirements will be crucial for hedge funds.

Another challenge is market volatility. The Hedge Fund AI Market is sensitive to fluctuations in global financial markets. Developing AI solutions that can effectively navigate and predict market volatility will be essential for hedge funds to maintain their competitive edge.

Competitive Landscape and Key Players in Hedge Fund AI Market

The competitive landscape in the Hedge Fund AI market is characterized by a mix of innovative startups and established financial institutions. This blend of new and experienced players is driving innovation and growth in the sector.

Key Players in Hedge Fund AI Market

Some of the key players in the Hedge Fund AI market include:

- Two Sigma (United States)

- Renaissance Technologies (United States)

- DE Shaw (United States)

- Citadel (United States)

- AQR Capital Management (United States)

- Man Group (United Kingdom)

- Bridgewater Associates (United States)

- BlackRock (United States)

- Point72 Asset Management (United States)

- Millennium Management – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Hedge Fund AI Report |

| Base Year | 2024 |

| Segment by Type |

· Machine learning algorithms · Predictive analytics |

| Segment by Application |

· Risk Management · Investment Strategies |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Hedge Fund AI Market is set for significant growth, driven by technological advancements and increasing adoption of AI solutions. As highlighted in the previous sections, regions like the U.S. are leading this growth, fueled by innovations and strategic investments in AI.

Key Findings Summary

The market’s trajectory is influenced by factors such as emerging trends, regulatory frameworks, and geopolitical dynamics. Understanding these elements is crucial for stakeholders to navigate the evolving landscape effectively.

Future Outlook

Looking ahead, the Hedge Fund AI Market is expected to continue its upward trend, with AI playing an increasingly vital role in hedge fund operations. As the market expands, it is essential for industry players to stay abreast of the latest developments and adapt to changing regulatory and economic conditions.

Global Hedge Fund AI Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Hedge Fund AI Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalHedge Fund AI players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Hedge Fund AI Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Hedge Fund AI Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Hedge Fund AI Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected value of the Hedge Fund AI Market by 2025?

The Hedge Fund AI Market is expected to reach $1.17 billion worldwide by 2025.

What is driving the growth of the Hedge Fund AI Market?

The growth is driven by strategic opportunities, particularly in the U.S., and the increasing adoption of artificial intelligence in hedge funds to enhance operational efficiency and investment strategies.

How is machine learning impacting hedge fund strategies?

Machine learning is transforming how hedge funds operate. It allows them to make more complex investment choices and manage risks better.

What are the regulatory challenges faced by the Hedge Fund AI Market?

The sector is subject to strict regulatory frameworks that vary across different regions, affecting the adoption and implementation of AI solutions.

How do geopolitical factors impact the Hedge Fund AI Industry?

Geopolitical factors, including global economic trends and trade policies, significantly impact the industry by affecting market volatility and influencing hedge fund strategies.

What types of AI solutions are used in hedge funds?

The types of AI solutions used include machine learning algorithms, natural language processing, and predictive analytics, each with different applications across various hedge fund strategies.

What are the main areas where AI is being used in the Hedge Fund industry?

The main areas include risk management and investment strategies, where AI improves hedge funds’ ability to handle risk and make informed investment choices.

How does the adoption of AI vary across regions?

The adoption of AI varies across regions, influenced by factors such as the level of AI adoption, regulatory environments, and market dynamics.

What is the current state of the Hedge Fund AI Market in the U.S.?

The U.S. is a major player in the Hedge Fund AI Market, thanks to technological advancements and investments in AI startups, making it a frontrunner in this industry.

What are the prospects for the Hedge Fund AI Market in the U.K.?

The U.K.’s market is influenced by its regulatory environment and the adoption of AI in hedge funds, with ongoing efforts to enhance AI adoption despite post-Brexit challenges.

What role does Singapore play in the Hedge Fund AI Market?

Singapore plays a strategic role, using its position as a financial center and benefiting from government initiatives to promote AI, making it an appealing place for hedge funds.

What are the emerging trends in the Hedge Fund AI Market?

Emerging trends include technological advancements in AI and the increasing adoption of machine learning, driving further growth in the market.

Who are the key players in the Hedge Fund AI Market?

The market is characterized by a with several major companies adopting various competitive strategies to maintain their market position.