Parcel Sortation Systems Market Anticipated to Reach $3.02 Billion by 2025: Driven by E-Commerce in the U.S., China, and the U.K.

The Parcel Sortation Systems Market is crucial to the logistics industry, automating the sorting and directing of packages in warehouses and distribution centers. These systems use advanced technologies like conveyors, scanners, robotics, AI, and machine vision to efficiently handle large quantities of packages.

- Last Updated:

Parcel Sortation Systems Market Expands Rapidly in Q1 and Q2 2025

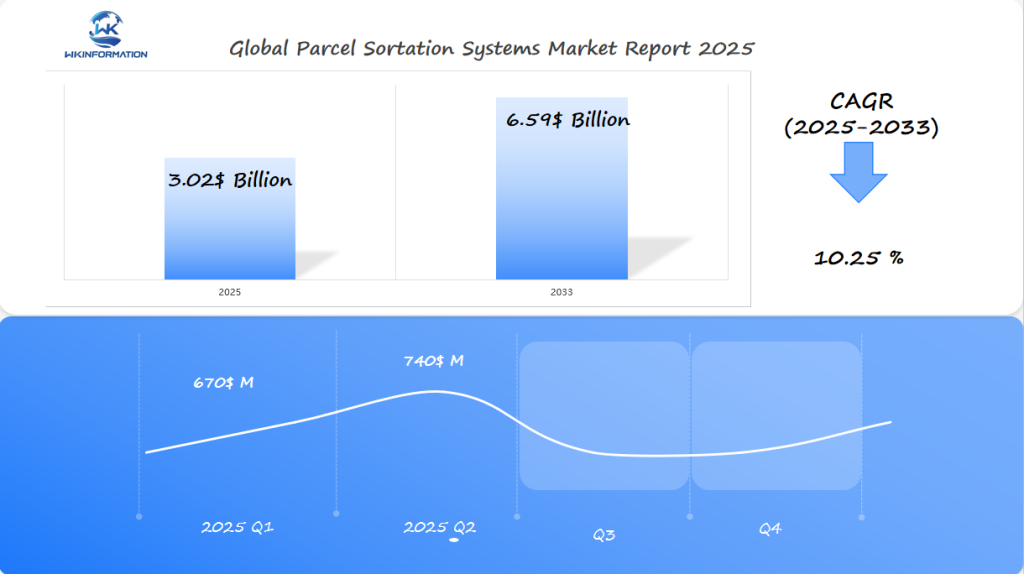

The Parcel Sortation Systems market is set to reach $3.02 billion in 2025, with a robust CAGR of 10.25% from 2025 to 2033. Q1 2025 revenue is forecasted at $670 million, rising to about $740 million in Q2. The surge is driven by booming e-commerce, increasing shipment volumes, and the pressure to optimize last-mile delivery. Automated sortation technologies using vision systems, robotics, and AI algorithms are becoming standard.

Analysis of Upstream Conveyor and Sensor Tech and Downstream Logistics Networks Market Size and Projected Growth

The global parcel sortation systems market was valued at approximately USD 2.01 billion in 2023. Projections indicate substantial growth, with the market expected to reach around USD 3.02 billion by 2025. This growth trajectory continues, estimating the market size to extend to USD 3.50 billion by 2032, driven primarily by advancements in upstream conveyor and sensor technology.

Compound Annual Growth Rate (CAGR)

Between 2024 and 2030, the market is anticipated to grow at a compound annual growth rate (CAGR) of around 9.3%. This steady CAGR reflects the increasing reliance on automated solutions for handling high volumes of parcels, particularly in e-commerce sectors across regions such as the U.S., China, and the U.K.

Revenue Forecasts

- 2025 Revenue Estimate: USD 3.02 Billion

- 2032 Revenue Estimate: USD 3.50 Billion

These revenue forecasts underscore the market’s potential, highlighting significant opportunities for industry stakeholders to capitalize on emerging technologies.

Implications for Industry Stakeholders

The implications of this robust CAGR are multifaceted:

- Investment Opportunities: The high growth rate indicates lucrative investment prospects in both hardware and software segments of parcel sortation systems.

- Technological Advancements: Continued innovation in conveyor systems, sensor technology, and AI integration will be critical for maintaining competitive advantage.

- Operational Efficiency: Enhanced automation will lead to significant improvements in operational efficiency, reducing manual labor dependency and increasing throughput capacity.

Understanding these dynamics is crucial for stakeholders aiming to navigate and leverage the burgeoning parcel sortation systems market effectively.

Trends include AI-powered sorting, modular systems, and last-mile automation

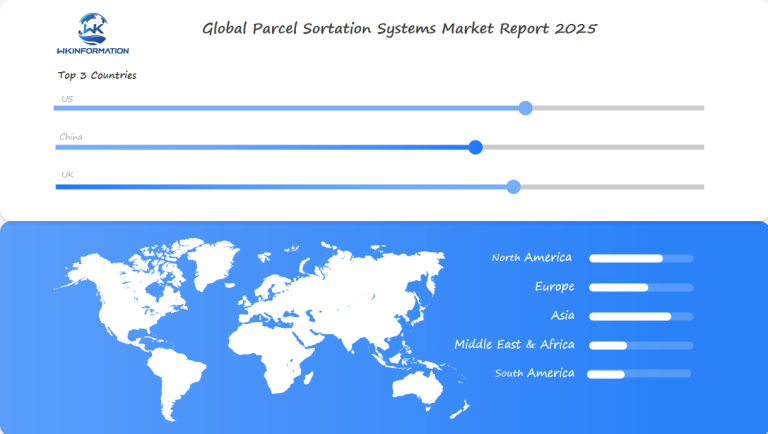

Asia Pacific holds the largest share of the global parcel sortation systems market, accounting for nearly 40% of overall revenue. This dominance is supported by rapid e-commerce growth in China, India, and South Korea, along with proactive government investments in logistics infrastructure. Companies benefit from a large base of cost-effective hardware manufacturers and a tech-savvy consumer population driving higher parcel volumes. The result: accelerated adoption of AI-powered vision systems, scalable modular sorters, and robotics integration across warehouse and distribution centers.

Key factors boosting Asia Pacific’s lead:

- Booming online retail platforms such as Alibaba and JD.com.

- Local manufacturing hubs producing affordable conveyor and sensor solutions.

- National logistics plans supporting warehouse automation in urban and rural areas alike.

North America shows steady growth driven by established e-commerce giants like Amazon, FedEx, and UPS. These players invest heavily in next-generation parcel automation to support high throughput, reduce labor dependency, and optimize last-mile delivery networks. The region’s regulatory environment favors innovation, allowing companies to pilot advanced AI-driven sorting algorithms and deploy micro-fulfillment centers near urban cores.

Implications for North American stakeholders:

- Competitive differentiation: Investments in modular systems enable rapid scaling during seasonal peaks.

- Labor market adaptation: Automation addresses rising wages and labor shortages across U.S. fulfillment hubs.

- Tech partnerships: Collaboration with software vendors accelerates deployment of predictive analytics for dynamic route planning.

Europe presents strong growth potential as e-commerce penetration deepens across both mature markets (U.K., Germany) and emerging economies (Eastern Europe). Strict regulations around delivery timelines increase demand for reliable sortation solutions that guarantee accuracy and speed. European distribution centers are turning to hybrid systems—combining cross-belt sorters with automated conveyors—to meet next-day delivery expectations while minimizing energy consumption.

Growth opportunities in Europe include:

- Adoption of modular sortation designs for flexibility in historic or space-constrained warehouses.

- Focus on sustainability, with operators seeking energy-efficient hardware options.

- Increased investment by 3PLs seeking to differentiate through advanced automation offerings.

AI-powered sorting, modular architecture for easy expansion, and enhanced last-mile automation remain critical trends shaping each region’s approach to parcel sortation system deployment. These regional dynamics set the stage for ongoing innovation as the market continues its upward trajectory.

Limitations due to high installation costs, floor space, and labor integration

Revenue Contributions from Hardware vs. Software/Services

The parcel sortation systems market is divided into two main segments: hardware and software/services. Hardware holds a significant share of the revenue, accounting for approximately 54% to 70%. This includes essential components such as:

- Conveyor Belts

- Roller Conveyors

- Tilt Trays

- Shoe Sorters

- Cross-Belt Sorters

These components are crucial for the physical movement and sorting of parcels in distribution centers.

On the other hand, software and services are growing segments. The increasing need for automation and the complexities of maintaining these systems drive demand for advanced software solutions. These solutions manage tasks such as:

- Real-Time Tracking

- Data Analytics

- System Integration

Maintenance and after-sales services also contribute significantly to this segment’s growth.

Types of Parcel Sortation Systems

Different types of parcel sortation systems cater to various business needs:

- Loop Parcel Sortation Systems:

- Advantages: High throughput, ideal for e-commerce operations with large volumes.

- Usage: Commonly used in major e-commerce warehouses.

- Linear Parcel Sortation Systems:

- Advantages: Modularity, scalability.

- Usage: Suitable for facilities requiring flexible expansion options.

- Tilt-Tray Sorters:

- Advantages: Accuracy, handling diverse parcel sizes.

- Usage: Preferred in facilities with varied parcel dimensions.

- Cross-Belt Sorters:

- Advantages: Speed, efficiency.

- Usage: Effective in high-speed sorting environments like postal services.

- Shoe Sorters:

- Advantages: Gentle handling, versatility.

- Usage: Ideal for fragile items or mixed product lines.

Geopolitical Trade Volumes, Labor Laws, and Logistics Policy Shaping Deployments

E-commerce expansion continues to set the pace for investments in parcel sortation systems worldwide. International trade volumes have surged in tandem with digital shopping trends, prompting logistics operators to overhaul their sorting infrastructure. Markets like the U.S., China, and the U.K. have experienced unprecedented parcel volume spikes, pushing both private and public sector stakeholders to prioritize automation.

Key drivers shaping this deployment wave:

- E-commerce Expansion:

- The sheer growth in online transactions creates higher throughput requirements for distribution centers. Automated sortation systems enable logistics providers to manage these surges without compromising accuracy or speed. Companies such as Amazon and Alibaba have rapidly scaled their fulfillment capacity with high-speed sorters, reducing manual touchpoints and human error.

- Consumer Demand for Fast Deliveries:

- Express delivery models are now standard expectations among consumers. With same-day and next-day shipping becoming the norm, logistics networks must support tight delivery windows. Automated sorting lines powered by AI and robotics allow for real-time routing adjustments and greater operational agility, helping meet these demands even during peak seasons.

- Labor Shortages:

- Persistent labor shortages in warehousing intensify the need for automation. Parcel sortation systems fill critical gaps where manual labor is insufficient or unavailable. In regions with strict labor laws or rising wage pressures, technology offers a sustainable path forward, balancing cost control with productivity gains.

Logistics policy reforms also play a role as governments update customs regulations, cross-border procedures, and workplace safety standards to keep pace with global e-commerce flows. This regulatory environment encourages further deployments of advanced sorting technologies across major logistics hubs.

Type Segmentation: Cross-Belt, Tilt-Tray, Shoe Sorters, and Automated Conveyors

Businesses face several challenges when implementing advanced parcel sortation systems. However, by exploring automated sortation solutions, these challenges can be mitigated.

1. High Initial Capital Investment:

- Investing in state-of-the-art sortation technology requires significant financial resources.

- Costs associated with purchasing and installing systems like cross-belt sorters, tilt-trays, shoe sorters, and automated conveyors can be prohibitive for small to mid-size enterprises.

2. Integration Complexity:

- Integrating new sortation systems with existing warehouse management infrastructure can be complex.

- Ensuring seamless communication between new technologies and legacy systems often demands customized solutions and expert handling.

3. Handling Oversized Parcels:

- While advanced sortation systems are highly efficient for standard-sized parcels, they often struggle with irregular or oversized items.

- Businesses may need to invest in additional equipment or modify existing systems to accommodate such parcels, adding to the complexity and cost.

By addressing these challenges, companies can optimize their logistics operations and fully leverage the benefits of automated parcel sortation.

Application Segmentation: E-commerce, Retail, Postal, and 3PL Logistics

The Parcel Sortation Systems Market supports a range of industry verticals, each with unique throughput needs and operational challenges. Leading parcel sortation applications include:

1. E-commerce Fulfillment Centers

Rapid order growth demands scalable, high-speed solutions. Systems must handle diverse package sizes, seasonal volume spikes, and frequent SKU changes. Companies like Beumer Group have responded with innovations such as the AutoDrop system, which leverages AI to boost bulk sorting speeds while minimizing manual intervention.

2. Retail Distribution Hubs

Retailers rely on parcel sortation systems to optimize omnichannel distribution strategies—enabling ship-from-store, click-and-collect, and rapid replenishment models. Vanderlande Industries B.V. provides modular sorters that adapt quickly to evolving retail workflows without extensive downtime.

3. Postal & Courier Services

National postal operators and private couriers require robust systems capable of managing millions of parcels daily. Flexibility in handling irregular or non-standard parcels is crucial. Interroll Group addresses these demands with the MCP PLAY system, a modular conveyor platform designed for seamless expansion and low maintenance.

4. Third-Party Logistics (3PL)

3PL providers need highly configurable automation to serve multiple clients with varying requirements on short notice. Daifuku Co. delivers scalable cross-belt sorters and software integrations tailored for dynamic multi-client environments.

Key players like Beumer Group, Interroll Group, Vanderlande Industries B.V., and Daifuku Co. consistently develop technologies that set new efficiency benchmarks in the Parcel Sortation Systems Market. Their systems enable businesses to meet rising customer expectations for speed and accuracy across e-commerce, retail, postal, and logistics sectors—empowering organizations to remain competitive in fast-moving supply chains.

Global Parcel Sortation Systems Market Distribution Across Warehouse-Intensive Regions

Warehouse-intensive regions play a crucial role in driving the parcel sortation systems market. This growth is influenced by two main factors: the projected growth of e-commerce and rapid advancements in technology.

Leading the Way: Asia Pacific’s Advantage

Asia Pacific is leading the charge, thanks to its high concentration of manufacturing hubs and logistics zones in countries like China, India, and South Korea. These nations are making use of government-backed infrastructure investments to speed up the adoption of automated solutions.

Transforming Urban Deliveries: The Rise of Micro-Fulfillment Centers

One of the emerging trends in these high-volume areas is the rise of Micro-Fulfillment Centers (MFCs). MFCs are specifically designed for urban environments and enable same-day or next-day delivery by decentralizing inventory closer to consumers. With their compact design and automation capabilities, MFCs can increase throughput capacity while also being energy efficient—a crucial factor as sustainability standards become stricter.

Key Regional Insights

Here are some key insights into the different regions driving the parcel sortation systems market:

Asia Pacific

This region holds approximately 40% market share, primarily due to surging parcel volumes and lower hardware production costs.

North America

In North America, major distribution centers in the U.S. are heavily investing in next-generation automation to meet rising consumer expectations and reduce reliance on labor.

Europe

European warehousing clusters are focusing on regulatory compliance and seamless cross-border logistics. They are integrating AI-driven sortation to achieve greater operational agility.

These developments highlight how evolving supply chain strategies and technological innovations are creating new opportunities for the expansion of parcel sortation systems in regions with dense warehouse networks.

U.S. Leads in Parcel Automation Investment and Network Optimization

The United States is leading the way in investing in parcel automation and optimizing logistics networks. This is mainly due to the rapid growth of e-commerce and ongoing advancements in technology. Major players in the logistics industry, such as Amazon, FedEx, and UPS, are making significant investments in advanced systems for sorting packages to meet the increasing demand for fast and efficient delivery services.

Key Trends Shaping Developments:

1. E-commerce Growth Projections

The ongoing rise in online shopping is driving the need for automated solutions for sorting packages. The U.S. market benefits from established e-commerce giants that prioritize efficient logistics networks.

2. Technological Advancements

Innovations like AI-powered vision systems and robotics are transforming the process of sorting packages. These technologies enhance accuracy and speed in sorting, which are crucial for handling large volumes of parcels.

3. Micro-Fulfillment Centers

These smaller, localized distribution hubs enable faster delivery times while optimizing space and energy usage. They play a critical role in enhancing throughput capacity, particularly in urban areas where space is limited.

Industry Impact:

1. Investment in Automation

Companies are focusing on scalable solutions such as modular conveyor systems and AI-driven sorters. This investment helps streamline operations, reduce reliance on manual labor, and improve overall efficiency.

2. Network Optimization

Advanced data analytics and predictive algorithms allow for better route planning and inventory management. This results in more reliable delivery schedules and improved customer satisfaction.

The combination of these trends ensures that the U.S. remains a leader in the market for systems used to sort packages, continually pushing the boundaries of what is possible through innovation and strategic investment.

China drives demand with high-volume e-commerce and smart logistics

China’s position in the parcel sortation systems market is defined by relentless e-commerce growth and rapid technological advancements. With platforms like Alibaba, JD.com, and Pinduoduo processing billions of parcels annually, Chinese logistics providers face unprecedented pressure to optimize throughput, accuracy, and energy efficiency.

Key factors shaping this landscape include:

- E-commerce Growth Projections: China’s online retail sales continue to set global records, driving demand for automated infrastructure capable of managing surging parcel volumes. In 2023 alone, the country handled over 110 billion express parcels—a figure expected to climb as rural and cross-border e-commerce expand.

- Smart Logistics Networks: Investments in AI-driven sortation technology, robotics, and machine vision are widespread. Companies like Cainiao and SF Express deploy highly automated hubs featuring cross-belt sorters, robotic arms, and data-driven traffic management systems.

- Micro-Fulfillment Centers: Urban centers see a rise in compact automated facilities designed for rapid order picking and same-day delivery. These centers use advanced parcel sortation systems to boost local throughput while minimizing energy consumption and labor costs.

China’s approach focuses on integrating these cutting-edge solutions with national logistics policies and digital infrastructure. This synergy positions China as a global leader in the deployment of next-generation parcel sortation technologies—setting benchmarks for scalability, speed, and efficiency across the sector.

U.K. expands usage in retail fulfillment centers and postal modernization

The U.K. is seeing a significant increase in the use of parcel sortation systems, thanks to strong growth in e-commerce and advancements in technology. The retail sector, in particular, has made substantial investments in fulfillment centers with advanced sorting solutions to meet the rising demand for online shopping.

Key Trends:

1. Micro-Fulfillment Centers

These compact facilities are gaining popularity as they promise to enhance throughput capacity while maintaining energy efficiency. By strategically locating these centers closer to urban areas, retailers can ensure faster delivery times and improved customer satisfaction.

2. Technological Advancements

Innovations like AI-powered sorting algorithms and robotics are changing the way parcels are managed within postal services. These technologies not only improve accuracy but also significantly reduce processing times.

3. Retail Fulfillment Centers

Retailers are expanding their fulfillment infrastructure to handle the surge in online orders. Parcel sortation systems play a critical role in streamlining operations, enabling quicker order processing and dispatch.

Postal Modernization:

The U.K. postal sector is undergoing a transformation to accommodate the growing volume of parcels resulting from e-commerce activities. Automated sortation systems are being integrated to optimize routing and delivery efficiency, ensuring that postal services can keep up with consumer expectations for speedy deliveries.

Investments in these technologies reflect a broader trend towards automation and efficiency

Future Trends Point to Robotic Sorting and Edge Computing in Parcel Systems

E-commerce growth projections highlight an increasing need for efficient parcel sortation systems. As e-commerce continues its rapid expansion, technological advancements become crucial in meeting the demand for quick and accurate parcel sorting. Micro-fulfillment centers are emerging as a key solution, offering enhanced throughput capacity while maintaining energy efficiency.

Robotic Sorting Innovations:

- AI-Powered Vision Systems: Utilize machine learning algorithms to identify and sort parcels with high accuracy.

- Autonomous Mobile Robots (AMRs): Navigate warehouse environments independently, transporting parcels to their designated locations.

- Collaborative Robots (Cobots): Work alongside human workers, enhancing productivity and reducing manual labor.

Edge Computing Integration:

- Real-Time Data Processing: Edge computing enables immediate analysis of data at the source, improving response times and decision-making.

- Reduced Latency: Minimizes delays in communication between devices, ensuring efficient operations within parcel sortation systems.

- Enhanced Security: Offers localized data processing, reducing the risk of data breaches during transmission.

These trends underscore the importance of embracing cutting-edge technologies to stay competitive in the evolving parcel sortation systems market. Robotics and edge computing not only optimize operational efficiency but also align with the sustainability goals of modern logistics networks.

Competitive Landscape Featuring Integrators, OEMs, and Software Solution Vendors

Key players in the parcel sortation systems market are prioritizing automation and intelligent software integration to enhance sorting efficiency and accuracy. They are increasingly investing in emerging markets across Southeast Asia and Latin America to capitalize on the rapid growth of e-commerce and the rising demand for streamlined logistics infrastructure.

Key Players:

-

Siemens Logistics (Germany)

-

Vanderlande Industries (Netherlands)

-

Dematic (United States)

-

Honeywell Intelligrated (United States)

-

BEUMER Group (Germany)

-

Fives Group (France)

-

Daifuku (Japan)

-

KNAPP AG (Austria)

-

SSI Schaefer (Germany)

-

Murata Machinery (Japan)

Overall

| Report Metric | Details |

| Report Name | Global Parcel Sortation Systems Market Report |

| Base Year | 2024 |

| Segment by Type |

· Cross-Belt · Tilt-Tray · Shoe Sorters · Automated Conveyors |

| Segment by Application |

· E-commerce · Retail · Postal · 3PL Logistics |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Parcel Sortation Systems Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Parcel Sortation Systems Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Parcel Sortation Systems Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Parcel Sortation Systems Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Parcel Sortation Systems Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Parcel Sortation Systems Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Parcel Sortation Systems Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Parcel Sortation Systems Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key technological trends influencing parcel sortation systems?

Key trends include AI-powered sorting, modular system designs, last-mile automation, robotic sorting, and edge computing integration to enhance efficiency and throughput capacity.

What challenges do businesses face when implementing advanced parcel sortation systems?

Businesses often encounter high installation costs, significant floor space requirements, labor integration complexities, capital investment demands, and challenges handling oversized parcels during implementation.

Who are the major players driving innovation in the parcel sortation systems market?

Leading companies include Beumer Group, Interroll Group, Vanderlande Industries B.V., and Daifuku Co., known for developing cutting-edge solutions like BEUMER Group’s AutoDrop system and Interroll’s MCP PLAY system.

How does e-commerce growth impact the adoption of parcel sortation systems?

The rapid expansion of e-commerce significantly drives demand for automated sorting solutions worldwide as consumer expectations for fast deliveries increase, prompting logistics companies to adopt advanced parcel sortation technologies.