High Voltage Switch Disconnector Market Set to Surpass $1.78 Billion by 2025 with Growth Focused on Saudi Arabia, U.S., and Spain

The high voltage switch disconnector market is projected to exceed $1.78 billion by 2025, driven by significant growth in Saudi Arabia, the U.S., and Spain, fueled by grid modernization, renewable energy projects, and infrastructure investments.

- Last Updated:

High Voltage Switch Disconnector Market Insights for Q1 and Q2 2025

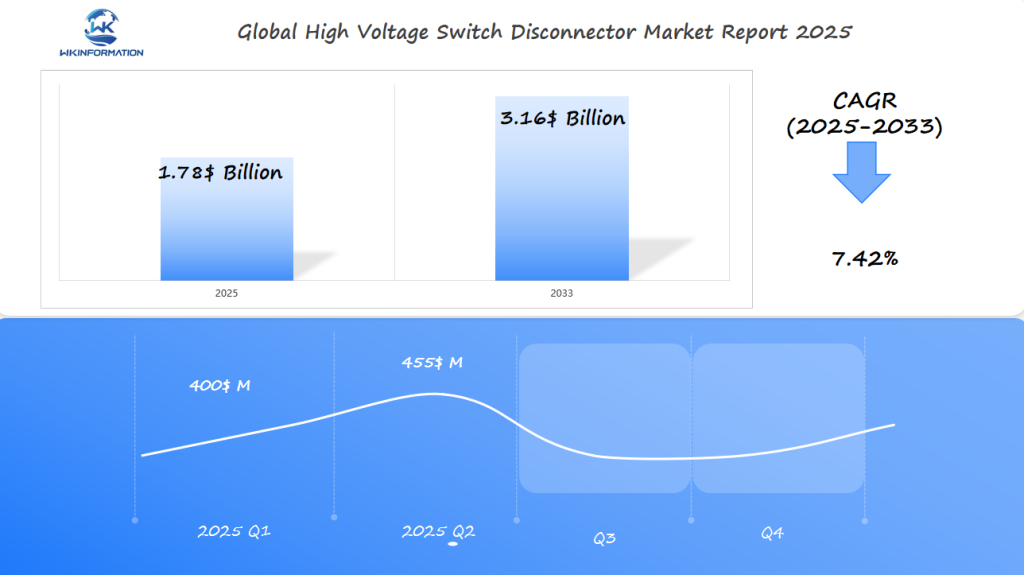

The High Voltage Switch Disconnector market is projected to reach $1.78 billion in 2025, reflecting a CAGR of 7.42% through 2033. Q1 2025 market performance is estimated at $400 million, increasing to roughly $455 million in Q2 amid rising global transmission and substation development.

Key drivers include the expansion of renewable energy grids, power reliability requirements, and increasing utility-scale investment in high-voltage protection devices. Saudi Arabia, the U.S., and Spain are the most active markets, backed by infrastructure modernization programs and grid safety regulations. These regions are expected to influence both volume demand and product standardization trends going forward.

Exploring the Upstream and Downstream Flow from Manufacturing to Utility Deployment

Overview of Manufacturing High Voltage Switch Disconnectors

Manufacturing high voltage switch disconnectors involves a meticulous process that prioritizes quality and safety. Key stages in the manufacturing process include:

- Design and Prototyping: Developing blueprints and models to ensure the disconnector meets required specifications.

- Material Selection: Choosing robust materials like stainless steel, copper, and high-grade insulators for durability.

- Component Fabrication: Crafting individual parts such as contacts, arc chutes, and operating mechanisms.

- Assembly: Integrating components into a cohesive unit with precise alignment.

- Testing and Quality Control: Conducting rigorous tests to verify operational reliability under high voltage conditions.

Importance of Efficient Utility Deployment

Efficient utility deployment is crucial for maintaining grid stability and operational efficiency. Proper deployment ensures:

- Reduced Downtime: Quick installation minimizes power outages.

- Enhanced Safety: Ensures safe maintenance by isolating sections of the electrical grid.

- Operational Reliability: Guarantees consistent performance under varying load conditions.

Understanding the Upstream Flow in the Production Process

The upstream flow of high voltage switch disconnector production includes all activities leading up to final assembly. Key aspects involve:

- Raw Material Procurement: Sourcing quality materials from reliable suppliers.

- Subcomponent Manufacturing: Producing essential parts like insulating supports and contact systems.

- Logistics Coordination: Efficient transport of materials and subcomponents to the assembly plant.

Analyzing the Downstream Flow Towards End-user Installation

Once manufactured, the downstream flow focuses on delivering products to end-users and ensuring proper installation. It encompasses:

- Distribution Channels: Managing logistics for transporting finished products to utility providers or industrial clients.

- Installation Services: Providing technical support for correct installation in substations or industrial sites.

- After-sales Support: Offering maintenance services and technical assistance for optimal operation over the product’s lifespan.

Efficient management of both upstream and downstream flows is essential for timely delivery, operational excellence, and customer satisfaction in the high voltage switch disconnector market.

Trends Shaping Demand: Grid Expansion, Safety, and Remote Operation

Grid Expansion Trends

Grid expansion trends have a direct correlation with the rising demand for high voltage switch disconnectors. As utilities invest in upgrading and extending transmission networks to accommodate urbanization, renewable energy integration, and electrification of transportation, the need for reliable isolation devices grows. In regions undergoing major grid modernization—such as Saudi Arabia’s Vision 2030 projects or U.S. infrastructure bills—the deployment of new substations and transmission lines requires robust switch disconnectors capable of handling higher voltages and larger currents. This drives manufacturers to innovate with modular designs and scalable solutions tailored for new and retrofitted grids.

Safety Regulations

Safety regulations remain a powerful force in shaping product requirements within this market. National and international standards—IEC 62271, IEEE C37, and regional codes—set out strict criteria for arc fault containment, contact visibility, mechanical endurance, and fail-safe operation. Compliance is not optional; utilities and industrial operators demand equipment certified to meet these benchmarks. Recent trends show a shift toward eco-friendly alternatives that minimize the use of SF₆ gas while maintaining high interrupting capacity, prompted by growing environmental oversight.

Advancements in Remote Operation Technologies

Advancements in remote operation technologies are reshaping expectations at every level of power distribution. IoT-enabled switch disconnectors now allow real-time status monitoring, predictive maintenance alerts, and even autonomous switching from central control centers. Utilities benefit from reduced field crew interventions, faster outage response times, and enhanced personnel safety—especially in hazardous environments or extreme weather scenarios. Motorized actuators and wireless communication modules are becoming standard features in new installations, signaling a move towards fully digital substations.

These trends are not isolated; they interact to define both the technical roadmap for manufacturers and the strategic priorities for utilities and grid operators seeking future-ready infrastructure.

Regulatory and Technical Challenges Impacting Equipment Selection

Navigating the regulatory landscape is crucial for compliant product development in the high voltage switch disconnector market. Regulations often vary by region, impacting the design and manufacturing processes. Ensuring that products meet international standards such as IEC (International Electrotechnical Commission) or IEEE (Institute of Electrical and Electronics Engineers) is critical. Compliance with these standards guarantees safety, reliability, and performance, which are essential for gaining market acceptance.

Addressing technical challenges involves tackling issues related to insulation, arc quenching, and mechanical endurance. High voltage switch disconnectors must withstand extreme electrical stresses without compromising functionality. The use of SF6 gas in some designs raises environmental concerns due to its high global warming potential, prompting a shift towards alternative, eco-friendly solutions.

Criteria for selecting suitable equipment based on industry standards include:

- Voltage Rating: Ensure the switch disconnector can handle the maximum system voltage.

- Current Capacity: Verify that the device supports the required load current.

- Insulation Type: Choose between air-insulated or gas-insulated options based on specific needs.

- Environmental Impact: Prefer eco-friendly alternatives to SF6 gas where possible.

- Durability: Assess mechanical robustness and lifespan under operational conditions.

By adhering to these criteria, you can select equipment that not only complies with regulatory requirements but also meets technical performance standards essential for reliable operation.

Geopolitical Factors Affecting Equipment Standards and Trade Restrictions

Geopolitical influences play a significant role in setting equipment standards for high voltage switch disconnectors. Various countries have distinct regulatory frameworks influenced by their political relations, technological advancements, and economic priorities. For instance, European nations typically emphasize stringent safety and environmental standards due to their commitment to sustainable energy policies. Conversely, emerging markets might prioritize cost-effective solutions to accelerate infrastructure development.

Impact of trade restrictions on market dynamics and player strategies:

- Tariffs and Import Regulations: Countries often impose tariffs and import regulations that affect the pricing and availability of high voltage switch disconnectors. This can lead to increased costs for manufacturers and end-users, influencing market competitiveness.

- Export Controls: Some nations implement export controls on critical electrical components, impacting global supply chains and limiting access to advanced technologies in regions with restrictive policies.

- Sanctions: Economic sanctions can disrupt the supply chain for essential materials needed in manufacturing high voltage switch disconnectors, compelling companies to seek alternative sources or adjust their production strategies.

- Regional Alliances: Trade agreements between countries can facilitate smoother transactions and standardize equipment specifications, promoting consistency across international markets.

The interplay between geopolitical factors and trade restrictions necessitates adaptive strategies from market players. Companies must navigate these complexities by aligning their product development with international standards while remaining agile in response to shifting regulatory landscapes. By understanding the implications of geopolitical influences on equipment standards, manufacturers can better position themselves in a competitive global market.

Market Segmentation by Current Ratings, Design Types, and Mounting Options

High voltage switch disconnectors have various specifications that allow for customized solutions in different power system needs. One of the main factors in choosing a product is its current rating. Manufacturers produce switch disconnectors with a wide range of current options—usually between 400A and over 4000A—to ensure safe functioning in low, medium, and high-load situations. National transmission grid operators usually need devices rated above 2000A, while industrial facilities may choose models within the 800A to 1600A range for substation or equipment isolation.

Design variations cater to operational demands and installation environments. The market includes:

- Air-insulated switches—favored for simplicity and cost effectiveness.

- Gas-insulated (SF6 or alternatives)—chosen for compactness and high dielectric strength, suitable for urban installations where footprint is critical.

- Vacuum-type disconnectors—gaining attention for their eco-friendliness and reduced maintenance needs.

- Fused switch disconnectors—integrate circuit protection with isolation, widely used in industrial panels.

The variety of mounting options available shows the need to accommodate switch disconnectors into different physical setups:

- Panel-mounted units integrate directly into control cabinets or switchgear assemblies.

- Floor-standing designs serve large substations or outdoor installations.

- Wall-mounted options optimize space in confined indoor settings or on utility poles.

This segmentation ensures that end users can match device specifications precisely to application scenarios—whether upgrading substations in dense city centers, integrating renewables at remote sites, or reinforcing safety in hazardous industrial zones. Adaptable configurations help streamline deployment and maintenance while supporting compliance with evolving technical standards.

Application Scope Across Transmission, Industrial, and Renewable Sectors

High voltage switch disconnectors play a crucial role across various sectors, ensuring reliable and safe electrical operations. Their applications span transmission networks, industrial environments, and the renewable energy sector.

Transmission Sector Applications

In transmission networks, high voltage switch disconnectors are vital for isolating electrical components during maintenance or emergencies. They enhance operational safety by de-energizing parts of the grid, preventing electrical hazards. Key applications include:

- Substation Integration: Disconnectors are integrated within substations to manage high voltage lines effectively.

- Grid Segmentation: Used to segment different parts of the grid for localized maintenance without disrupting overall supply.

- Fault Isolation: Essential for isolating faults quickly to maintain grid stability and prevent widespread outages.

Industrial Sector Usage

The industrial sector relies on high voltage switch disconnectors for electrical safety and operational efficiency. These devices ensure that power can be safely disconnected during equipment servicing or in emergency situations. Typical usage scenarios include:

- Control Panels: Vital components in control panels for isolating circuits during maintenance.

- Motor Control Centers (MCCs): Used within MCCs to provide safe isolation of high-powered motors.

- Process Industries: In process industries like chemical plants and refineries, they ensure safe operation by isolating critical processes from power supply.

Renewable Energy Sector Demand

As the renewable energy sector grows, so does the demand for high voltage switch disconnectors. These devices are essential for maintaining reliable infrastructure in solar and wind power installations. Their applications include:

- Solar Farms: Used to isolate sections of photovoltaic arrays during maintenance or fault conditions.

- Wind Turbines: Enable safe disconnection of turbines from the grid for maintenance or when adverse conditions arise.

- Energy Storage Systems: Integral in managing energy storage systems by providing isolation capabilities to enhance safety and reliability.

High voltage switch disconnectors cater to diverse needs across these sectors, reinforcing their importance in modern electrical infrastructure.

Regional Analysis of Market Penetration and Infrastructure Investments

Regional market analysis of high voltage switch disconnectors reveals marked differences in both adoption rates and investment strategies across the globe. Distinct growth trajectories are shaped by local infrastructure priorities, regulatory frameworks, and energy transition agendas.

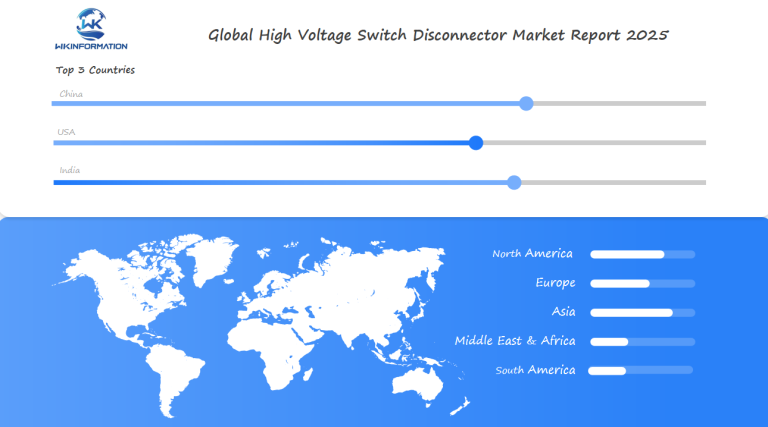

1. Asia-Pacific: Leading in Market Penetration

Asia-Pacific leads in market penetration, accelerated by ambitious infrastructure projects in China, India, and Southeast Asia. Large-scale investments target urban grid expansions, rural electrification, and the integration of renewable sources. Governments allocate significant funds for transmission upgrades and smart grid initiatives, opening substantial opportunities for both global and regional manufacturers.

2. North America: Demand Driven by Grid Modernization

Noth America demonstrates robust demand driven by grid modernization efforts and the need for reliable power delivery. The U.S., in particular, channels heavy investments into grid hardening against extreme weather events and cyber threats. Adoption rates increase as utilities retrofit aging substations with advanced switching technology, prioritizing resilience and operational efficiency.

3. Europe: Steady Growth with Renewable Shift

Europe maintains a steady pace of market growth. Stricter energy efficiency regulations and an aggressive shift toward renewables—especially in countries like Germany, France, and Spain—propel infrastructure investments into new interconnection lines and digital substations. Adoption is further stimulated by EU funding mechanisms targeting cross-border energy security.

4. Middle East & Africa: Rising Penetration with Development Plans

Middle East & Africa experience rising penetration aligned with national development plans. Saudi Arabia’s Vision 2030 initiative funds large-scale utility projects, grid interconnections, and industrial electrification. Regional governments prioritize modern switchgear to support economic diversification.

5. Latin America: Moderate Growth Linked to Local Programs

Latin America registers moderate market penetration linked to local government infrastructure programs. Countries like Brazil and Mexico invest strategically in transmission upgrades to accommodate population growth and renewable integration.

The link between infrastructure investments impact and switch disconnector demand is direct: regions prioritizing grid reliability, expansion, or modernization consistently register higher adoption rates, shaping future market dynamics for manufacturers and suppliers alike.

Saudi Arabia’s Utility Growth and Grid Modernization Strategy

Saudi Arabia is undergoing significant changes in its utility sector, driven by the government’s Vision 2030 initiative. This comprehensive plan focuses on diversifying the economy, reducing dependency on oil, and modernizing infrastructure. Key components of this strategy include:

1. Electric Mobility Ecosystems

Saudi Arabia is investing heavily in electric vehicle (EV) infrastructure to promote sustainable transport solutions. This involves the deployment of high voltage switch disconnectors to ensure reliable and safe operation of EV charging stations.

2. Energy-efficient Grid Management

To enhance energy efficiency, the country is upgrading its power grids with advanced technologies. Smart grid initiatives are being implemented to optimize electricity distribution, reduce losses, and improve reliability. High voltage switch disconnectors play a crucial role in these smart grid projects by providing precise control and safety mechanisms.

3. Renewable Energy Projects

With a strong emphasis on renewable energy, Saudi Arabia is developing large-scale solar and wind power plants. These projects require robust electrical infrastructure, including high voltage switch disconnectors, to handle the fluctuating power generation and integrate it seamlessly into the national grid.

The combination of these initiatives highlights Saudi Arabia’s commitment to advancing its utility sector and modernizing its electrical infrastructure. The demand for high voltage switch disconnectors is expected to surge as these projects progress, making Saudi Arabia a key market for industry players.

U.S. Investment in Grid Hardening and High Voltage Infrastructure

The United States is making significant progress in improving its electrical grid and developing high voltage infrastructure. These investments are essential for ensuring a reliable and resilient power supply, especially in the face of increasing threats from natural disasters and cyber-attacks.

Key Initiatives:

1. Grid Hardening

This initiative focuses on reinforcing existing electrical grids to withstand severe weather events. It involves upgrading transmission lines, substations, and implementing advanced technologies for real-time monitoring and control.

2. High Voltage Infrastructure

This initiative involves expansion projects aimed at integrating renewable energy sources such as wind and solar into the grid. High voltage switch disconnectors play a crucial role in efficiently managing these high-capacity systems.

Notable Projects:

1. Smart Grid Deployment

This project involves incorporating smart grid technologies like automated switches and sensors to enhance operational efficiency and reduce outage times.

2. Federal Funding Programs

Initiatives such as the Infrastructure Investment and Jobs Act (IIJA) allocate substantial funds for modernizing the electrical grid, with a focus on safety, reliability, and sustainability.

Impact on Market Growth:

Investments in grid hardening and high voltage infrastructure are expected to drive the demand for advanced high voltage switch disconnectors. Companies like ABB Ltd, Siemens AG, and Schneider Electric SE are actively involved in providing solutions tailored to meet the evolving needs of the U.S. market.

Future Prospects:

The continued emphasis on grid hardening is likely to spur innovation in switch disconnector technology, leading to improved performance standards and enhanced safety measures across critical infrastructure networks.

Spain’s Renewable Transition Driving Switch Disconnector Demand

Spain’s aggressive push toward renewable energy is directly influencing the demand for high voltage switch disconnectors. As the nation continues to ramp up investments in solar, wind, and hybrid power plants, grid stability and safe integration of distributed energy resources become critical. High voltage switch disconnectors are essential for isolating segments of the grid during maintenance, ensuring operational safety while integrating intermittent renewables.

Key drivers in the Spanish market include:

- Substantial Renewable Capacity Additions: Spain’s target to achieve 74% renewable electricity generation by 2030 requires extensive new grid infrastructure. Each new wind farm or solar park installation necessitates reliable switching equipment for both transmission and distribution networks.

- Smart Grid Deployment: Integration of digital substations and advanced metering infrastructure calls for switch disconnectors capable of supporting remote control, diagnostics, and real-time monitoring.

- Grid Modernization Initiatives: The ongoing upgrade of legacy electrical networks focuses on minimizing outages and accommodating bidirectional power flows created by prosumers and utility-scale renewables.

- Stringent Safety Standards: Compliance with European Union directives pushes utilities to specify high-performance disconnectors that meet rigorous testing and environmental requirements.

Investment in Spain’s grid expansion projects—such as those supporting electric vehicle charging corridors or cross-border interconnections—continues to shape the technical specifications and adoption pace for advanced switch disconnector solutions. This evolving landscape puts pressure on manufacturers to deliver compact, modular designs optimized for rapid deployment in diverse renewable scenarios.

Forecasting the Role of Digitalization in Switch Disconnector Markets

Digitalization is rapidly redefining the landscape for high voltage switch disconnectors. Utilities and grid operators are shifting toward smart infrastructure, prioritizing equipment that offers real-time monitoring, predictive maintenance, and remote operability. This shift is not just about convenience; it brings measurable improvements in reliability and operational efficiency.

Key trends shaping this digital transformation include:

- IoT Integration: Modern switch disconnectors increasingly feature sensors and communication modules that transmit status data to central control systems. This connectivity provides instant fault detection, allowing rapid isolation of affected segments and minimizing downtime.

- Advanced Data Analytics: With access to detailed operational data, utilities can optimize maintenance schedules, predict component failures, and extend asset life cycles. Predictive analytics reduces unplanned outages and lowers overall maintenance costs.

- Remote Operation Capabilities: Motorized disconnectors enabled by digital controls mean that switching operations can occur from secure control rooms, improving safety for personnel during adverse or hazardous conditions.

- Cybersecurity Focus: As digital adoption grows, so does the emphasis on securing critical infrastructure from cyber threats. Market leaders are investing in encrypted protocols and robust network security features.

- Integration with SCADA Systems: Compatibility with Supervisory Control and Data Acquisition (SCADA) platforms enables seamless coordination of grid assets, supporting smarter load management and faster response to fluctuating energy demands.

Digitalization is fast becoming a standard expectation rather than an optional upgrade. The result is a clear path toward grids that are more resilient, intelligent, and responsive to the evolving demands of modern energy ecosystems.

Key Competitors and Their Strategic Technological Roadmaps

Major players in the high voltage switch disconnector market are shaping their strategies to align with regional infrastructure priorities and evolving grid requirements. Each region’s unique growth drivers—Saudi Arabia’s utility expansion, the U.S. focus on grid hardening, and Spain’s renewable energy transition—directly influence how these companies invest in technology, product design, and market penetration.

Saudi Arabia Utility Growth Plan & Grid Modernization Initiatives

- ABB Ltd, Siemens AG, and Schneider Electric SE are closely tracking Saudi Arabia’s Vision 2030 utility growth plan. They’re prioritizing the development of robust, modular switch disconnectors compatible with large-scale grid modernization.

- Projects targeting digital substations and smart grid integration demand equipment that supports IoT-based diagnostics, predictive maintenance, and remote operation—capabilities featured in new lines from GE Grid Solutions and Mitsubishi Electric.

- Investments are directed toward SF6-free technology to address environmental mandates within the kingdom’s sustainability framework.

U.S. Grid Hardening Efforts & High Voltage Infrastructure Investment

- Eaton Corporation and Hubbell Power Systems are leading efforts to supply ruggedized switch disconnectors for harsh U.S. climates, supporting FEMA-backed grid hardening measures.

- Emphasis falls on arc-resistant designs, real-time fault detection, and rapid isolation features that meet stringent NERC reliability standards.

- Technological roadmaps highlight collaboration with utilities for pilot projects integrating advanced analytics into SCADA systems.

Spain Renewable Energy Transition & Switch Disconnector Demand Drivers

- Spanish energy reforms and aggressive renewables targets have prompted companies like Schneider Electric SE and Siemens AG to introduce compact disconnectors compatible with distributed energy resources (DERs) and solar/wind integration.

- Demand is driven by Spain’s rollout of smart grids, electrification of mobility infrastructure, and regulatory incentives promoting low-loss switching technologies.

- Crompton Greaves Ltd stands out in supplying utility-scale solutions tailored to the evolving needs of solar parks and wind farms across Iberia.

These company strategies demonstrate direct responses to local investment trends, regulatory shifts, and technical challenges unique to each market. The competitive landscape adapts continuously as digitalization, renewables integration, and resilience become central themes for high voltage switch disconnector innovation.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global High Voltage Switch Disconnector Report |

| Base Year | 2024 |

| Segment by Type |

· Air-insulated switches · Vacuum · Fused switch disconnectors |

| Segment by Application |

· Transmission · Industrial · Renewable Sectors |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Rising investments in grid modernization, renewable integration, and electrical safety are set to propel the High Voltage Switch Disconnector Market well beyond $1.78 billion by 2025. Manufacturers are under pressure to deliver smarter, more reliable, and environmentally conscious solutions, responding directly to regulatory shifts and end-user expectations.

Key takeaways for stakeholders:

- Digitalization and automation will define new standards of efficiency and operational transparency.

- Strategic regional investment—with Saudi Arabia, the U.S., and Spain leading infrastructure upgrades—will continue shaping demand patterns.

- Technical innovation remains a priority as utilities seek equipment that delivers safety without compromising sustainability.

As global energy needs surge and grids evolve, the high voltage switch disconnector market will continue to reward companies focused on compliance, adaptability, and forward-thinking technology. Reliable switching infrastructure is no longer optional; it’s essential for future-ready power systems.

Global High Voltage Switch Disconnector Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: High Voltage Switch Disconnector Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalHigh Voltage Switch Disconnector players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: High Voltage Switch Disconnector Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: High Voltage Switch Disconnector Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: High Voltage Switch Disconnector Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the current market trends in the high voltage switch disconnector market?

The high voltage switch disconnector market is currently influenced by grid expansion, enhanced safety regulations, and advancements in remote operation technologies, driving demand and shaping product development.

How does the manufacturing process impact the utility deployment of high voltage switch disconnectors?

Efficient manufacturing processes ensure high-quality production of switch disconnectors, which is critical for seamless upstream flow and effective downstream deployment to utilities, ultimately enhancing reliability in electrical infrastructure.

What regulatory and technical challenges affect equipment selection in the high voltage switch disconnector market?

Navigating complex regulatory compliance requirements and addressing technical challenges such as durability and compatibility are key factors influencing the selection of suitable high voltage switch disconnectors based on industry standards.

How do geopolitical factors influence equipment standards and trade restrictions in this market?

Geopolitical influences shape equipment standards by affecting regulatory frameworks, while trade restrictions impact market dynamics and compel players to adapt their strategies to maintain competitiveness.

In which sectors are high voltage switch disconnectors primarily applied?

High voltage switch disconnectors are extensively used in transmission networks, industrial settings for electrical safety measures, and the renewable energy sector to support reliable infrastructure development.

What regional developments are driving growth in the high voltage switch disconnector market?

Regional growth is propelled by Saudi Arabia’s utility expansion and grid modernization, U.S. investments in grid hardening and high voltage infrastructure, and Spain’s renewable energy transition increasing demand for advanced switch disconnectors.