Mass Payment Solutions Market Set to Reach $119.6 Billion by 2025: Growth in the U.S., China, and India

Explore the rapid expansion of Mass Payment Solutions Market as digital transactions evolve. Learn key drivers, market trends, and growth opportunities across major economies worldwide.

- Last Updated:

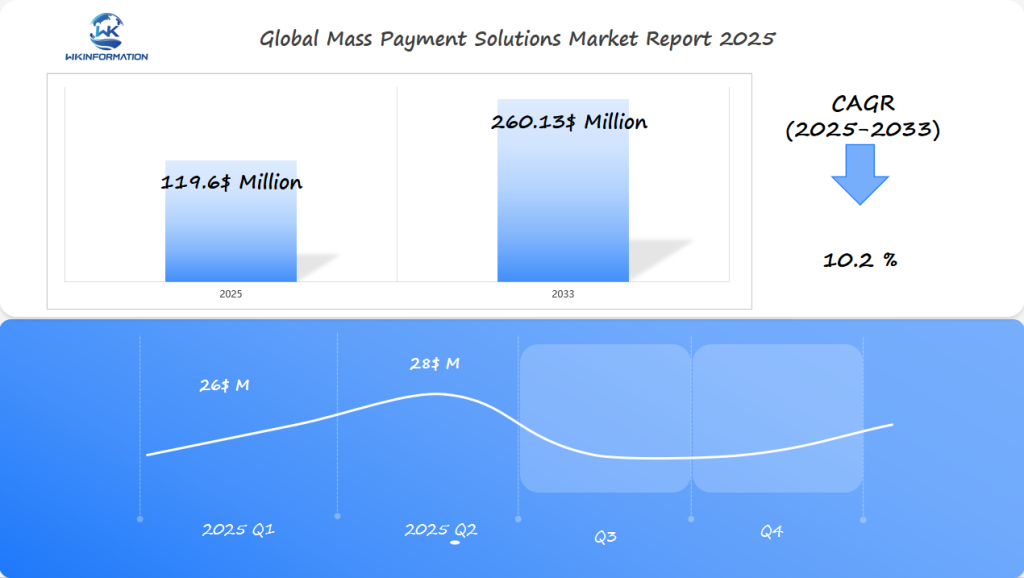

Mass Payment Solutions Market in Q1 and Q2 of 2025

The Mass Payment Solutions market is expected to hit $119.6 billion in 2025, with a CAGR of 10.2% from 2025 to 2033. In Q1 2025, the market will generate about $26 million, increasing to $28 million in Q2. The growth is driven by the gig economy, digital wallets, and cross-border payments.

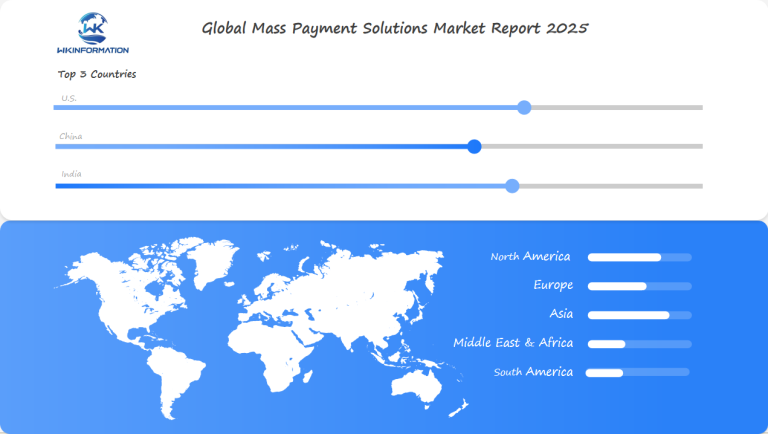

The U.S. and China are key players, with platforms like PayPal and Alipay leading the way in mobile payments. India’s growing digital infrastructure is also contributing to the market, especially in digital remittances and mobile-first payment solutions. Additionally, the expansion of e-commerce platforms worldwide and the need for seamless cross-border payments further fuels demand for mass payment solutions. The rise of cryptocurrencies and blockchain technology also plays a role in shaping the future of the payment landscape, offering new opportunities for innovation.

Key Takeaways

- Global mass payment solutions market projected to reach $119.6 billion by 2025

- United States, China, and India driving significant market expansion

- Digital transaction technologies transforming payment infrastructures

- Advanced technologies like AI and blockchain enhancing payment solutions

- Increasing demand for secure and efficient digital payment platforms

Upstream and downstream industry chain analysis of Mass Payment Solutions

The payment processing ecosystem is a complex network of financial technologies and services. It involves many stakeholders working together. They help make financial transactions smooth across different platforms.

Key parts of the fintech infrastructure include:

- Payment gateway providers

- Financial institutions

- Technology platforms

- Regulatory compliance organizations

Banking partnerships are vital for creating new payment solutions. These partnerships help companies grow and build better transaction networks.

| Upstream Components | Downstream Components |

| Technology Development | End-User Services |

| Software Engineering | Consumer Payment Platforms |

| Security Infrastructure | Merchant Payment Systems |

The world of digital payments is changing fast. Technological advancements drive innovation in the payment ecosystem. This leads to more efficient and secure ways to make transactions.

As technology gets better, the connections between stakeholders improve. This makes payments smoother and safer worldwide.

Trends in digital transaction processing and automated payment systems

The world of finance is changing fast with new digital payment solutions. Real-time payments are key, allowing for quick money transfers on many platforms and devices.

AI is making payment systems smarter and safer. Banks use machine learning to:

- Spot fraud quickly

- Make payments more personal

- Speed up transaction processing

Contactless payments are growing fast, especially in cities. The COVID-19 pandemic made people use touchless payments more. Now, mobile wallets and contactless cards are common.

New technologies are changing how we make payments. They make transactions faster, safer, and easier. Banks and tech firms are working hard to create better payment systems.

Regulatory challenges surrounding cross-border payments and fraud prevention

The world of international transactions is changing fast. This brings big challenges for banks and financial groups. They need to use top-notch cybersecurity to fight off new digital dangers.

Some big challenges in cross-border payments are:

- Following many international financial rules

- Setting up strong fraud prevention systems

- Tracking complex cross-border deals

- Keeping financial data safe from cyber attacks

Financial groups are working on new tech solutions. Risk management platforms use AI and machine learning. They spot odd transaction patterns quickly, making payments safer.

New rules are coming to help with international deals. These rules want to make payments smooth but also very secure. This way, banks can work well without taking too many risks.

New tech is changing how we handle payments. Blockchain and advanced encryption are key. They help make international payments safer and clearer.

Geopolitical impact on international payment infrastructure and security

The world of international finance is changing fast because of complex politics. Global payment networks are facing new challenges. They must deal with data sovereignty and how to handle transactions across borders.

Important political factors affecting global finance

Some key political factors that can influence global finance include:

- Regional trade tensions affecting payment systems

- New cybersecurity threats

- Different rules in various countries

- Big economies choosing to use different technologies

The need for strong plans against political risks

Financial companies need strong plans to handle these political risks. Data sovereignty is key, with countries setting strict rules to keep their financial data safe.

| Geopolitical Factor | Impact on Payment Networks | Risk Level |

| US-China Technology Tensions | Restricted financial technology exchanges | High |

| European Data Protection Regulations | Increased compliance requirements | Medium |

| Sanctions and Trade Restrictions | Disrupted international payment flows | High |

Today’s payment systems are built to withstand political challenges. Companies must keep updating their global financial plans. This helps them keep transactions safe and smooth across borders.

Type segmentation: ACH, wire transfer, and mobile payment systems

The world of electronic funds transfer is changing fast. Many payment technologies are changing how we handle money. These digital solutions meet different financial needs.

Digital payment systems have grown a lot. They now offer advanced ways to make instant payments. The main types are:

- ACH (Automated Clearing House) networks

- Wire transfer systems

- Mobile payment platforms

ACH Payment Mechanisms

ACH payments are key in electronic funds transfer. They make it safe to process many financial transactions at once. They help with direct deposits, payroll, and regular bill payments, all at low costs.

Wire Transfer Technologies

Wire transfer systems move money quickly between banks. Digital wallets use these systems for fast, secure international money transfers.

Mobile Payment Innovations

Today’s mobile payment systems use top-notch security. They turn phones into powerful tools for managing money. These systems make transactions easy and safe in many digital places.

Application Segments: E-commerce, International Remittance, and Corporate Disbursements

The market for mass payments is changing fast. It’s now easier for businesses and people to handle money across different areas. Digital payments are getting better at handling complex tasks in online shopping, sending money abroad, and business-to-business deals.

New payment systems are coming up with smart ways to meet different financial needs. Companies want solutions that can handle complex payments safely and quickly.

E-commerce Payment Solutions

Online shopping payments have gotten a lot easier. Thanks to advanced payment gateways, we now have:

- Seamless checkout experiences

- Multiple payment method integrations

- Real-time transaction verification

- Fraud detection mechanisms

International Remittance Platforms

How we send money across borders is changing. Digital platforms are now offering:

- Lower transaction fees

- Faster processing times

- Enhanced currency conversion rates

- Secure international money transfer capabilities

Corporate Disbursement Systems

B2B transactions are getting more advanced with new payment solutions. Businesses are using technologies that provide:

- Automated payment workflows

- Comprehensive financial reporting

- Global vendor management

- Compliance tracking

Global push toward frictionless payment experiences in e-commerce

The digital world is changing fast, thanks to customer needs. Now, people want one-click payments to make shopping online easier. This makes their experience better and more satisfying.

E-commerce sites are working hard to make checkout smooth. They aim to solve big problems in online shopping, like:

- Reducing cart abandonment rates

- Simplifying payment workflows

- Integrating multiple payment methods

- Enhancing transaction security

New payment tech uses smart algorithms and machine learning. It makes buying things online faster and safer. It also learns what each user likes.

Big tech companies are creating smart payment solutions. They focus on making things easy for users while keeping everything secure. This helps businesses keep more customers and sell more.

The push for easy payments is changing how we shop online. It’s leading to new tech in digital transactions. This means we can expect even more improvements in the future.

U.S. Market Driving Digital Wallet and B2B Payment Adoption

The United States is leading the way in mobile wallets and business payments. Digital payments are changing how we handle money, opening up new chances for growth.

Factors Driving the Use of Digital Wallets in the U.S.

What’s driving the use of digital wallets in the U.S. includes:

- More people using smartphones

- More comfort with mobile payments

- Better security

- Easier peer-to-peer payments

The Shift Towards Digital Payments

Businesses are moving to digital payments to make things easier. Now, sending money to friends or paying bills is common, thanks to apps like Venmo and Cash App.

Growth of Business Payments

In the U.S., business payments are growing fast. Companies want quick, safe ways to handle money. Mobile wallets are now key for any business. As digital transformation speeds up, the U.S. is at the top of payment tech innovation. It’s setting the standard for mobile and business financial solutions worldwide.

China's Digital Payment System Dominance and E-Commerce Evolution

China has changed the game with mobile payment platforms. WeChat Pay and Alipay lead the way, making money transfers easy and fast. They’ve created a new way to handle money that’s different from old methods.

The Rise of QR Code Payments

QR code payments have made a big splash. Now, people can pay with just a scan on their phones. This change has reached all levels of Chinese society, from small shops to big malls.

- WeChat Pay processes over 1 billion transactions daily

- Alipay supports more than 80% of mobile payments in China

- QR code payments have become ubiquitous in urban and rural areas

The Impact on E-Commerce

E-commerce sites have made shopping even easier by adding these payment options. This mix of mobile payments and online shopping has made China’s digital economy huge.

Data-Driven Business Strategies

WeChat Pay and Alipay’s systems give businesses useful data. This data helps them tailor their marketing and improve how they serve customers.

A Model for the World

China’s use of advanced tech has made it a world leader in digital payments. Other countries are looking to follow its example.

India's growing fintech ecosystem and mobile-first solutions

India’s shift towards digital has brought about a significant transformation in mobile banking and financial technology. The government’s initiative to promote a digital India has triggered a wave of financial innovation, particularly in the realm of mobile payments.

The Impact of UPI on India’s Payment Landscape

Unified Payments Interface (UPI) has revolutionized the way payments are made in India. Here are some key factors that have contributed to its success:

- Widespread adoption of smartphones in both urban and rural areas

- Streamlined processes for conducting digital transactions

- Increased access to financial services for individuals without bank accounts

Factors Driving Growth in Mobile Banking

The mobile banking industry in India is experiencing rapid growth. This can be attributed to several factors:

- Widespread availability of affordable smartphones

- Government initiatives supporting digital services

- A young population that is tech-savvy

The push for a digital India has positioned the country as a frontrunner in mobile payments globally. Both startups and established banks are joining forces to simplify, secure, and enhance the user experience of digital transactions.

With continued support from the government and advancements in technology, India’s fintech industry is poised to make significant contributions to the world of digital payments.

Future developments in blockchain-based payment platforms

The world of finance is changing fast thanks to blockchain-based payment platforms. This technology is making it easier for businesses and people to send money worldwide.

Some big changes in blockchain payment systems include:

- Enhanced security through decentralized transaction processing

- Reduced cross-border payment transaction costs

- Real-time settlement capabilities

- Increased transparency in financial transactions

Smart contracts are becoming a big deal for making payments easier. They are like automated rules that make sure money moves without any middlemen. This means faster and more accurate payments.

| Technology | Payment Speed | Transaction Cost |

| Traditional Banking | 2-5 business days | $25-$50 per transaction |

| Blockchain Platforms | Seconds to minutes | $0.10-$5 per transaction |

Big banks are looking into using blockchain to make payments better. They see it as a way to save money and make things more efficient.

As more people start using cryptocurrencies, blockchain is set to change how we do money worldwide. It promises faster, safer, and more accessible transactions.

Key players in cross-border mass payment solutions

The market for cross-border payments is changing fast. This is thanks to global payment providers, fintech startups, and traditional banks. They are making international money transfers easier and faster with new tech.

Key Players:

-

Helcim — Canada

-

Square — USA

-

Stripe — USA

-

Stax — USA

-

PaymentWorks — USA

-

Plastiq — USA

-

Capital One — USA

-

PayPal — USA

-

Adyen — Netherlands

-

Papaya Global — Israel

Fintech startups are shaking things up. They offer faster, clearer, and cheaper ways to send money. They use cool tech like AI and blockchain to make payments smoother.

Traditional banks are also changing. They’re investing in digital tools and teaming up with tech companies. This keeps them in the game as the financial world goes digital.

The race to innovate is ongoing. Global payment providers and fintech startups are always looking to improve how we send money.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Mass Payment Solutions Market Report |

| Base Year | 2024 |

| Segment by Type |

· ACH (Automated Clearing House) Networks · Wire transfer Systems · Mobile Payment Platforms |

| Segment by Application |

· Commerce · International Remittance · Corporate Disbursements |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The mass payment solutions market is on the verge of big changes. Fast technology and new digital payment ways are leading the way. Experts say we’ll see big growth in financial systems worldwide, changing how we deal with money.

Payment trends are moving towards easy, safe, and quick transactions. The market is expected to grow fast, especially in places like India and China. Investments in AI, blockchain, and mobile payments will help grow the market and open new chances for financial services.

Old payment systems are facing new challenges, pushing companies to make better, easier solutions. Using advanced security, machine learning, and blockchain will be key to staying ahead. Soon, digital wallets, cross-border payments, and fast transactions will be the norm.

As rules change and what people want from payments shifts, we’ll see a lot of new ideas. The next ten years will be all about fast, safe, and easy money handling. Companies that use new tech and understand global finance will lead this exciting change.

Global Mass Payment Solutions Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Mass Payment Solutions Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Mass Payment Solutions Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Mass Payment Solutions Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Mass Payment Solutions Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Mass Payment Solutions Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Mass Payment Solutions Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Mass Payment SolutionsMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the Mass Payment Solutions market?

The market is growing fast because more people are using digital payments. E-commerce is also on the rise. Countries like the U.S., China, and India are leading this growth.

How are technological advancements impacting payment solutions?

New technology is changing how we pay. It includes real-time payments and contactless transactions. These changes are affecting how businesses and consumers operate.

What payment methods are currently most prevalent?

Popular payment methods include ACH transfers and wire transfers. Mobile payments and digital wallets are also common. Blockchain-based platforms are new but growing fast.

How are cross-border payments being transformed?

Cross-border payments are getting better thanks to blockchain. They’re now faster and cheaper. This makes international transactions easier.

What role do mobile payments play in the global financial ecosystem?

Mobile payments are key, especially in India and China. They help more people access money. They also make transactions easy and support digital economies.

How are regulations affecting mass payment solutions?

Rules are changing to keep payments safe and fair. They cover data protection and international transactions. Payment providers must follow these rules closely.

What emerging technologies are shaping future payment solutions?

New tech like blockchain and AI is leading the way. Central bank digital currencies and smart contracts are also important. These innovations are changing payments.

How are e-commerce platforms improving payment experiences?

Online stores are making payments easier. They offer one-click payments and simple checkout. This helps keep customers from leaving their carts.

What challenges do mass payment solutions currently face?

Payment solutions face many challenges:

- They must stay secure and follow complex rules.

- They need to be fast and affordable.

- Keeping up with new tech is another big challenge.

How are different countries approaching digital payment innovations?

Countries have different strategies:

- The U.S. is focusing on digital wallets.

- China is leading in mobile payments.

- India is working to include more people through mobile solutions.