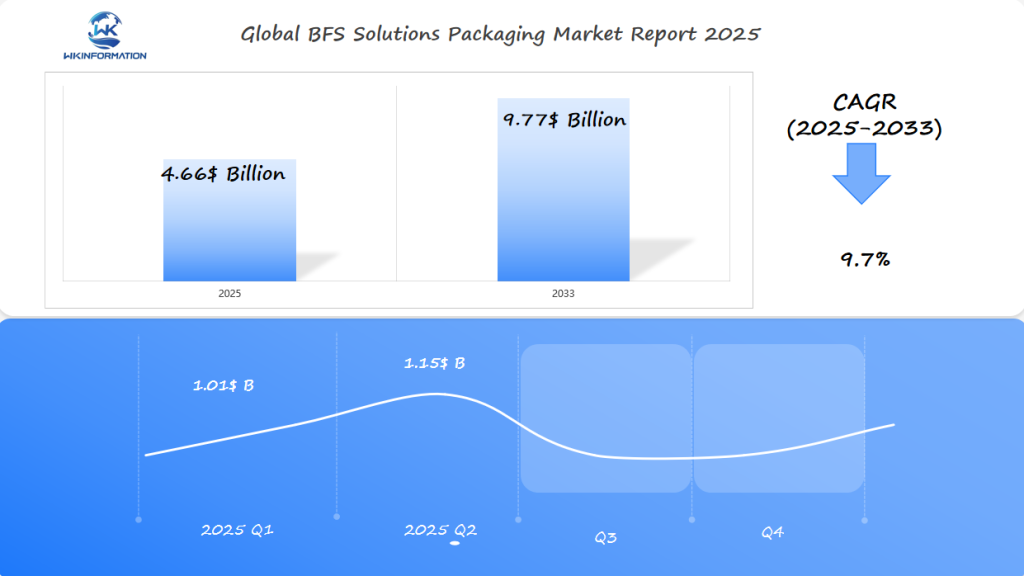

BFS Solutions Packaging Market to Reach $4.66 Billion by 2025: Growth Accelerates in the U.S., India, and Germany

Discover the BFS Solutions Packaging Market’s growth to $4.66 billion by 2025, with accelerating trends in the U.S., India, and Germany.

- Last Updated:

BFS Solutions Packaging Market in Q1 and Q2 of 2025

The global BFS (Blow-Fill-Seal) Solutions Packaging market is forecast to reach $4.66 billion in 2025, expanding at a CAGR of 9.7% from 2025 to 2033. Estimated Q1 revenues are around $1.01 billion, rising to approximately $1.15 billion in Q2, driven by accelerating pharmaceutical and sterile solution demands.

Key Market Insights:

- The U.S. remains a dominant market due to regulatory support for contamination-free packaging in biologics and vaccines.

- India is rapidly scaling up its contract manufacturing capacity, leveraging BFS technology for cost-efficient, high-volume production.

- Germany’s high precision standards are pushing innovations in multi-dose unit packaging, especially in ophthalmic and respiratory drugs.

- Automation integration, tamper-evident design improvements, and sustainability-focused materials are shaping the competitive edge in this sector.

Upstream and Downstream Industry Chain Analysis of BFS Solutions Packaging

The BFS solutions packaging market is closely connected to its upstream and downstream industry chains, making it important to understand the factors involved. The BFS industry chain includes the production of raw materials and machinery needed for BFS packaging, as well as the end-users of these packaging solutions, mainly pharmaceutical and healthcare companies. These companies are increasingly focusing on sustainability, which is reflected in their ESG strategies. A key aspect of this is managing their carbon footprints, particularly in relation to their supply chains. For instance, understanding and calculating Scope 3 emissions, which include all indirect emissions that occur in a company’s value chain, is becoming essential for these companies.

Understanding the BFS Industry Chain

The BFS industry chain is complex, with various stakeholders playing critical roles. Raw material suppliers provide the necessary inputs for BFS packaging, including plastics and other materials. Machinery manufacturers supply the equipment used in BFS packaging lines, which can range from compact to high-speed machines.

The BFS supply chain includes several key players:

- Raw material suppliers like Dow and LyondellBasell

- Machinery manufacturers such as Rommelag and Syntegon

- End-users, including major pharmaceutical companies like Pfizer and Johnson & Johnson

These players work together to ensure the smooth operation of the BFS industry chain, from the production of raw materials to the delivery of finished BFS packaging solutions.

Effective supply chain analysis is crucial for identifying areas of improvement and optimizing the BFS industry chain. By understanding the supply chain dynamics, stakeholders can better navigate the complexities of the BFS solutions packaging market.

Emerging trends in sterile packaging, automation, and pharma logistics

Emerging trends in the BFS solutions packaging market are driven by advancements in sterile packaging and automation. The need for more efficient, safe, and cost-effective packaging solutions has led to significant innovations in the industry.

Advances in Sterile Packaging

The BFS solutions packaging market is witnessing significant advancements in sterile packaging. Sterile packaging trends are focused on ensuring the highest level of product safety and integrity. This includes the development of new materials and packaging designs that minimize the risk of contamination.

Some of the key advances in sterile packaging include:

- Improved barrier properties to prevent contamination

- Innovative packaging designs that enhance product safety

- Use of advanced materials that are compatible with BFS technology

Automation in Pharma Logistics

Automation in pharma logistics is another significant trend in the BFS solutions packaging market. Automation is being increasingly adopted to improve efficiency, reduce costs, and enhance supply chain visibility.

The benefits of automation in pharma logistics include:

- Improved inventory management

- Enhanced supply chain visibility

- Reduced labor costs and increased productivity

The integration of BFS technology with automation in pharma logistics is expected to drive significant growth in the market. As the industry continues to evolve, we can expect to see even more innovative solutions emerge.

Regulatory and operational restrictions impacting BFS systems

The BFS solutions packaging market faces numerous challenges due to regulatory and operational restrictions. Despite its advantages, the BFS industry must navigate complex regulatory landscapes and operational hurdles to achieve widespread adoption.

Regulatory Challenges

One of the main regulatory challenges facing BFS systems is following the strict guidelines set by health authorities. Sterile packaging regulations are especially important in the pharmaceutical industry, where it is crucial to minimize the risk of contamination. BFS manufacturers must comply with regulations such as those set by the FDA and EMA, ensuring that their systems meet the necessary standards for sterility and product safety.

Variability in Regulatory Frameworks

Regulatory frameworks differ across various regions, making it more complicated for global manufacturers to comply. For example, the U.S. FDA has specific guidelines for using BFS technology in pharmaceutical packaging, while the European Medicines Agency (EMA) has its own set of rules.

| Regulatory Body | Guidelines for BFS | Key Requirements |

| U.S. FDA | Specific guidelines for BFS technology | Sterility, product safety |

| EMA | Regulations for BFS in pharmaceutical packaging | Compliance with EU standards |

Operational Limitations

Operational limitations also present significant challenges to the adoption of BFS systems. The technical complexities and high costs associated with BFS technology can be barriers to entry for some manufacturers. Additionally, the need for specialized training and maintenance can increase operational costs.

The BFS industry is working to address these operational challenges through innovations in machine design and process optimization. By improving efficiency and reducing costs associated with BFS systems, manufacturers can make this technology more accessible to a wider range of companies.

Furthermore, the development of more flexible and adaptable BFS systems can help manufacturers respond to changing regulatory requirements and market demands. This adaptability is crucial in an industry where regulatory landscapes are continually evolving.

Geopolitical supply chain shifts in sterile medical packaging

Trade Policies and Tariffs

-

Impact: Countries often impose tariffs on goods that affect industries like medical packaging. Trade wars or trade disputes can increase the cost of raw materials or finished products, leading to higher prices for sterile medical packaging. This can especially affect the flow of plastics, metals, and specialized materials from countries like China and India.

-

Example: The U.S.-China trade conflict has led to tariffs on a variety of materials, including plastic resins used in medical packaging. Such tariffs affect the costs and availability of packaging components in North America.

Global Shipping Disruptions

-

Impact: Geopolitical instability, such as conflicts in the Middle East or disruptions in global shipping lanes like the Suez Canal, can delay the transportation of materials used in sterile packaging. These delays can result in shortages and production backlogs.

-

Example: The 2021 Suez Canal blockage, which halted global shipping for several days, impacted the flow of raw materials for medical packaging and delayed deliveries of critical supplies to hospitals and clinics.

Sanctions and Export Restrictions

-

Impact: Political sanctions can prevent the export of essential materials from certain countries, leading to supply shortages. If countries with significant production capabilities in medical packaging (like China or Russia) are sanctioned, it could lead to difficulties in sourcing materials or finished products.

-

Example: In 2022, sanctions on Russia affected global supply chains, including medical supplies and packaging materials, especially those that require high levels of technical precision.

Regional Political Instability

-

Impact: Political instability in countries where medical packaging materials are sourced or manufactured can cause supply chain disruptions. This could result in factory shutdowns, labor strikes, or nationalization of industries, making it harder for companies to source critical components.

-

Example: Manufacturing hubs like China and India, which supply significant amounts of medical packaging materials, have faced political instability that can affect production and delivery timelines.

Environmental Regulations and Standards

-

Impact: Different countries or regions often implement varying environmental regulations, which can affect the materials used in medical packaging. As countries adopt stricter environmental policies, packaging manufacturers may be forced to switch to more sustainable but potentially more expensive materials.

-

Example: The European Union’s Green Deal and its ban on single-use plastics will influence medical packaging suppliers to adopt more sustainable alternatives, while also potentially raising costs and shifting production practices.

Type segmentation: compact, mid-volume, and high-speed BFS machines

BFS machines are categorized into compact, mid-volume, and high-speed types to cater to different manufacturing needs. This segmentation allows pharmaceutical and healthcare manufacturers to choose the most suitable BFS machine based on their production requirements.

Compact BFS Machines

Compact BFS machines are designed for small-scale production or research purposes. They offer flexibility and efficiency for manufacturers who require lower production volumes. These machines are ideal for companies looking to test the BFS technology or produce small batches of products.

The compact BFS machines are characterized by their smaller footprint, making them suitable for facilities with limited space. They also tend to be more cost-effective, reducing the initial investment for manufacturers.

High-Speed BFS Machines

High-speed BFS machines are used in large-scale commercial production, where high output is crucial. These machines are designed to produce a large volume of sterile products quickly and efficiently, making them essential for meeting the demands of the global pharmaceutical market.

High-speed BFS machines incorporate advanced technology to ensure consistent quality and reliability. They are equipped with sophisticated filling and sealing mechanisms that operate at high speeds without compromising the sterility of the products.

The choice between compact, mid-volume, and high-speed BFS machines depends on the specific needs of the manufacturer, including production volume, product type, and facility constraints.

| BFS Machine Type | Production Volume | Application |

| Compact BFS | Low to Medium | Research, Small-Scale Production |

| Mid-Volume BFS | Medium | Moderate Production Needs |

| High-Speed BFS | High | Large-Scale Commercial Production |

As the demand for sterile packaging continues to grow, the BFS market is expected to evolve with advancements in machine technology, further enhancing the capabilities of compact, mid-volume, and high-speed BFS machines.

Application segmentation: pharmaceuticals, nutraceuticals, and personal care

BFS solutions are increasingly being adopted in the pharmaceutical, nutraceutical, and personal care sectors due to their aseptic packaging capabilities. This technology is particularly beneficial for products that require sterile packaging to maintain their efficacy and safety.

Pharmaceuticals

In the pharmaceutical industry, BFS technology is utilized for packaging sterile drugs and vaccines. The process involves filling and sealing containers in a single machine, minimizing the risk of contamination. This method is highly efficient and ensures the sterility of the packaged products.

The use of BFS in pharmaceuticals is driven by the need for contamination-free packaging. BFS machines can produce containers that are not only sterile but also precisely engineered to meet the specific requirements of pharmaceutical products.

The nutraceutical and personal care industries also benefit from BFS technology, leveraging its ability to provide aseptic packaging. Nutraceutical products, such as dietary supplements, and personal care items, like lotions and creams, require packaging that maintains their quality and safety.

BFS machines are capable of handling a variety of products, from viscous liquids to powders, making them versatile for different applications. The technology ensures that the products are packaged in a clean environment, enhancing their shelf life and user safety.

- BFS technology offers aseptic packaging solutions for various industries.

- Pharmaceuticals benefit from contamination-free packaging for drugs and vaccines.

- Nutraceuticals and personal care products are packaged efficiently, maintaining their quality.

Global Deployment of BFS in Manufacturing Hubs

The global deployment of Blow-Fill-Seal (BFS) technology in manufacturing hubs is transforming the packaging landscape. BFS technology is being increasingly adopted due to its efficiency, sterility, and ability to meet stringent packaging standards.

BFS in Global Manufacturing

BFS technology is revolutionizing global manufacturing by providing a clean and efficient packaging solution. This technology is particularly beneficial in the pharmaceutical and healthcare sectors, where maintaining sterility is of utmost importance.

The rise in the adoption of BFS technology can be attributed to its numerous advantages, including reduced risk of contamination, accelerated production rates, and versatility in packaging design. Consequently, factories worldwide are integrating BFS technology into their operations.

Regional Manufacturing Hubs

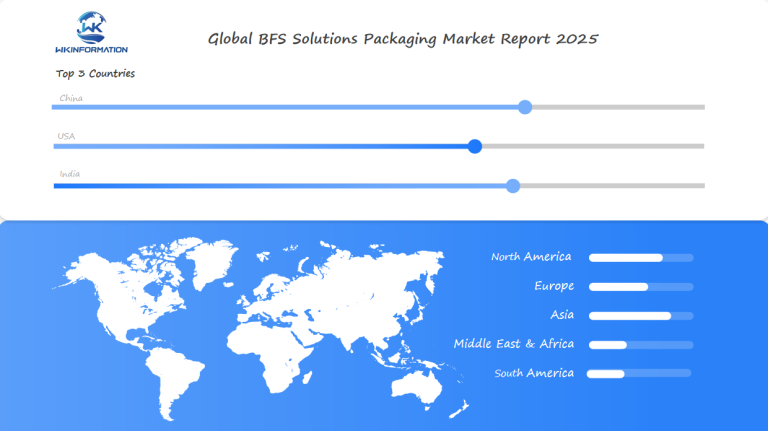

Several key regions are at the forefront of adopting BFS technology:

- North America, primarily driven by the U.S. pharmaceutical industry

- Europe, with Germany and Switzerland leading in pharmaceutical manufacturing

- Asia, where nations like India and China are emerging as significant manufacturing hubs

These regions are leveraging BFS technology to enhance their manufacturing capabilities and cater to the growing demand for sterile packaging.

BFS Technology in Global Manufacturing

| Region | Key Countries | Driving Factors |

| North America | U.S. | Demand from the pharmaceutical industry |

| Europe | Germany, Switzerland | Advanced manufacturing infrastructure |

| Asia | India, China | Growth in pharmaceutical manufacturing |

The global proliferation of BFS technology is anticipated to continue as more manufacturing hubs recognize its benefits. With ongoing advancements in this technology, we can expect even more effective packaging solutions that are both efficient and sterile.

U.S. Market Dominance in Healthcare-Grade Filling Systems

The U.S. BFS market is growing due to strict regulatory standards and a well-established pharmaceutical industry. The country’s advanced pharmaceutical sector requires top-notch packaging solutions, which makes healthcare-grade filling systems essential.

U.S. Market Overview

The U.S. is a dominant player in the global BFS solutions market, with a strong presence of leading manufacturers and suppliers. The market is characterized by high demand for sterile packaging, driven by the need to prevent contamination and ensure product safety.

Healthcare-grade filling systems are a crucial aspect of the BFS market in the U.S. These systems are designed to meet the stringent regulatory requirements of the pharmaceutical industry, ensuring the production of high-quality, sterile products.

Key Features of U.S. BFS Market

- Advanced BFS technology for sterile packaging

- High-speed filling systems for increased productivity

- Compliance with FDA regulations and guidelines

The U.S. BFS market is expected to continue its growth trajectory, driven by the increasing demand for safe and efficient packaging solutions in the pharmaceutical industry.

| Key Drivers | Impact on U.S. BFS Market |

| Stringent Regulatory Standards | High demand for healthcare-grade filling systems |

| Advanced Pharmaceutical Industry | Increased adoption of BFS technology |

| Growing Need for Sterile Packaging | Rise in demand for sterile packaging solutions |

India’s Cost-Effective Contract Manufacturing Landscape

BFS technology is transforming contract manufacturing in India by providing affordable solutions. India’s rise as a major center for contract manufacturing is fueled by the country’s skilled workforce, favorable business environment, and the use of BFS technology.

The BFS industry in India is experiencing significant growth due to its ability to provide sterile packaging solutions efficiently. This growth is further supported by India’s competitive labor costs and government initiatives to promote the pharmaceutical and healthcare sectors.

Contract Manufacturing in India

Contract manufacturing in India has become an attractive option for pharmaceutical and healthcare companies worldwide. The country’s ability to provide high-quality manufacturing services at competitive prices is a key factor in its growing popularity.

The use of BFS technology in contract manufacturing enhances the production process by ensuring sterility, reducing contamination risks, and improving product safety. This makes Indian contract manufacturers more appealing to global companies seeking reliable and efficient sterile packaging solutions.

Cost-Effectiveness of BFS in India

The cost-effectiveness of BFS technology is a significant advantage for contract manufacturers in India. BFS machines reduce the need for extensive cleaning and validation processes, thereby decreasing operational costs and increasing production efficiency.

A comparison of BFS with traditional filling methods highlights its cost benefits:

| Feature | BFS Technology | Traditional Filling Methods |

| Production Speed | High | Moderate |

| Contamination Risk | Low | Moderate to High |

| Operational Costs | Low | High |

The integration of BFS technology in India’s contract manufacturing sector is expected to continue growing, driven by the demand for cost-effective and efficient sterile packaging solutions. As the industry evolves, Indian contract manufacturers are likely to play an increasingly important role in the global pharmaceutical and healthcare supply chain.

Germany’s automation-led pharmaceutical production

Automation is transforming the pharmaceutical production industry in Germany, with BFS technology playing a vital role. The country’s advanced manufacturing capabilities, combined with a strong emphasis on automation, are enhancing efficiency and product quality.

This transformation is largely driven by the adoption of cutting-edge technologies like BFS (Blow Fill Seal) which streamline the manufacturing process. This automation not only improves productivity but also ensures a higher standard of product quality.

As we delve deeper into this topic, it becomes evident that the future of pharmaceutical production in Germany looks promising with these advancements in automation and technology.

Automation in German Pharma

The German pharmaceutical industry is using automation to improve production processes, lower costs, and ensure compliance with regulatory standards. BFS technology plays a crucial role in this automation-driven strategy, allowing for the manufacturing of top-notch, sterile products.

Key benefits of automation in German pharma include:

- Increased efficiency and productivity

- Improved product quality and consistency

- Enhanced regulatory compliance

- Reduced production costs

BFS Technology in Germany

BFS technology is being increasingly adopted in Germany’s pharmaceutical production due to its ability to provide aseptic filling and packaging in a single step. This not only reduces the risk of contamination but also streamlines the production process.

The use of BFS technology in Germany is expected to continue growing, driven by the need for efficient, high-quality production methods. As the industry continues to evolve, we can expect to see further innovations in automation and BFS technology.

Future potential in single-dose and on-demand sterile packaging

Emerging trends such as single-dose and on-demand sterile packaging are set to revolutionize the BFS market. The BFS solutions packaging market is about to undergo a significant transformation driven by consumer preferences for convenience and personalized healthcare products.

The shift towards single-dose packaging is gaining momentum due to its benefits in terms of patient compliance and reduced risk of contamination. BFS technology, with its ability to provide sterile and precise packaging, is well-positioned to cater to this growing demand.

Single-Dose Packaging

Single-dose packaging has become a major trend in the pharmaceutical industry, driven by the need for better patient compliance and safety. BFS technology offers a reliable and efficient solution for single-dose packaging, ensuring that each dose is sterile and accurately delivered.

The advantages of single-dose packaging include:

- Reduced risk of contamination

- Improved dosing accuracy

- Enhanced patient convenience

As the demand for personalized healthcare continues to grow, the role of BFS in single-dose packaging is expected to become increasingly important.

On-Demand Sterile Packaging

On-demand sterile packaging represents another significant opportunity for BFS technology. This approach enables the production of sterile packaging on demand, reducing the need for inventory storage and minimizing the risk of product expiration.

The benefits of on-demand sterile packaging include:

- Increased flexibility in production

- Reduced costs associated with inventory management

- The ability to respond quickly to changing market demands

As the pharmaceutical industry continues to evolve, the adoption of on-demand sterile packaging is likely to grow, further driving the demand for BFS solutions.

The Future of BFS

The future of BFS is closely tied to its ability to adapt to emerging trends such as single-dose and on-demand sterile packaging. As the industry continues to evolve, BFS technology is poised to play a crucial role in shaping the future of sterile packaging.

Competitive landscape in aseptic technology providers

As the aseptic technology market expands, competition among providers intensifies. The demand for high-quality, sterile packaging solutions is driving innovation and strategic partnerships among key players in the industry.

Here are some of the major companies operating in the aseptic technology space:

- Rommelag – Germany

- HealthSTAR – United States

- Unither Pharmaceuticals – France

- Weiler Engineering – United States

- Catalent – United States

- Asept Pak – United States

- BioConnection – Netherlands

- BirgiMefar Grup – Turkey

- Curida AS – Norway

- Gerresheimer AG – Germany

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global BFS Solutions Packaging Report |

| Base Year | 2024 |

| Segment by Type |

· Compact · Mid-Volume · High-Speed Bfs Machines |

| Segment by Application |

· Pharmaceuticals · Nutraceuticals · Personal Care |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The BFS solutions packaging market is set for significant growth, driven by its advantages in sterile packaging, efficiency, and cost-effectiveness. As the pharmaceutical and healthcare industries continue to evolve, BFS technology is expected to play an increasingly important role in meeting the demand for safe and reliable packaging solutions.

Emerging Market Trends

The BFS market outlook indicates a shift towards automation and single-dose packaging, driven by the need for increased efficiency and reduced costs. Market trends suggest a growing demand for BFS technology in emerging markets, particularly in regions with expanding pharmaceutical industries.

Future Projections

Future projections indicate that the BFS market will continue to grow, driven by advancements in technology and increasing demand from the pharmaceutical and healthcare sectors. As manufacturers seek to improve efficiency and reduce costs, BFS technology is likely to become an increasingly important component of packaging solutions.

Global BFS Solutions Packaging Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: BFS Solutions Packaging Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- BFS Solutions PackagingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global BFS Solutions Packagingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: BFS Solutions Packaging Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: BFS Solutions Packaging Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: BFS Solutions Packaging Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofBFS Solutions PackagingMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is BFS technology and how is it used in packaging?

BFS (Blow-Fill-Seal) technology is a process used to manufacture sterile containers, fill them with a product, and seal them in a single, continuous operation. It’s commonly used in the pharmaceutical and healthcare industries for packaging liquids, such as medications, vaccines, and nutritional supplements.

What are the benefits of using BFS technology in packaging?

BFS technology offers several benefits, including:

- Improved sterility

- Reduced contamination risk

- Increased efficiency

- Cost-effectiveness

It’s also a highly flexible technology that can be used to produce a wide range of container sizes and shapes.

What types of products are typically packaged using BFS technology?

BFS technology is commonly used to package:

- Pharmaceuticals

- Nutraceuticals

- Personal care products, such as eye wash, respiratory therapy solutions, and unit-dose medications

How does BFS technology compare to traditional packaging methods?

BFS technology offers several advantages over traditional packaging methods, including improved sterility, reduced risk of contamination, and increased efficiency. It’s also a more cost-effective option for many manufacturers.

What are the key factors driving growth in the BFS solutions packaging market?

The BFS solutions packaging market is driven by:

- Increasing demand for sterile packaging

- Growth in the pharmaceutical and healthcare industries

- The need for efficient and cost-effective packaging solutions

What are some of the emerging trends in BFS solutions packaging?

Emerging trends in BFS solutions packaging include:

- The increasing use of automation

- Advances in sterile packaging

- Growing demand for single-dose and on-demand packaging

How is BFS technology being used in different regions, such as the U.S. and India?

BFS technology is being used in various regions, including the U.S. and India, to meet the growing demand for sterile packaging. The U.S. is a dominant market for BFS solutions, while India is emerging as a significant hub for contract manufacturing using BFS technology.

What are some of the regulatory and operational challenges facing the BFS solutions packaging market?

The BFS solutions packaging market faces regulatory challenges, such as compliance with stringent guidelines set by health authorities, as well as operational limitations, including technical complexities and costs associated with BFS systems.

What is the outlook for the BFS solutions packaging market?

The BFS solutions packaging market is poised for significant growth, driven by its advantages in sterile packaging, efficiency, and cost-effectiveness. As the pharmaceutical and healthcare industries continue to evolve, BFS technology is expected to play an increasingly important role in meeting the demand for safe and reliable packaging solutions.