Financial Services Market on Track to Reach $35.86 Trillion by 2025: Major Moves in the U.S., Singapore, and Switzerland

Explore the latest trends and growth opportunities in the Financial Services Market as it expands globally, driven by digital transformation and emerging fintech solutions.

- Last Updated:

Financial Services Market in Q1 and Q2 of 2025

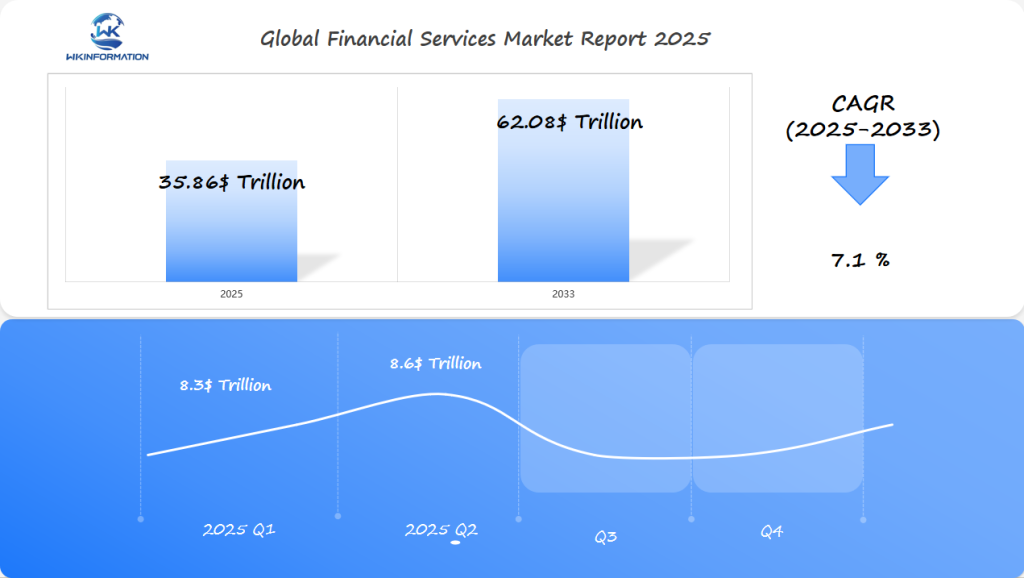

The Financial Services market is projected to reach $35.86 trillion in 2025, growing at a CAGR of 7.1% between 2025 and 2033. In Q1 2025, the market size is expected to be $8.3 trillion, increasing to $8.6 trillion in Q2. Digital transformation, including the rise of fintech, blockchain, and AI, is driving this growth.

The U.S. leads with advancements in digital banking, while Singapore and Switzerland are emerging as hubs for fintech and wealth management. As financial institutions focus on technology adoption, the market will continue expanding, especially in emerging regions like Asia. The growing popularity of decentralized finance (DeFi) is also impacting traditional banking models, driving financial services to innovate. The integration of AI in risk management and customer service further supports this growth, enhancing both efficiency and user experience.

Key Takeaways

- Global financial services market projected to reach $35.86 trillion by 2025

- Digital transformation driving significant market expansion

- Technological innovations revolutionizing financial service delivery

- Key markets like U.S., Singapore, and Switzerland leading global changes

- 7.1% compound annual growth rate indicates strong market potential

Upstream and Downstream Dynamics in the Financial Services Value Chain

The financial services value chain is a complex system of processes. It drives innovation and growth. Understanding the upstream and downstream dynamics is key to navigating the financial services landscape.

Upstream Dynamics

Upstream dynamics focus on foundational elements that shape the industry. These include:

- Regulatory frameworks and compliance mechanisms

- Technological infrastructure development

- Capital market innovations

- Research and product conceptualization

Downstream Dynamics

Downstream dynamics focus on customer-facing aspects. They directly impact service delivery and experience. Key components include:

- Distribution channels

- Customer engagement strategies

- Product personalization

- Digital service platforms

| Upstream Dynamics | Downstream Dynamics |

| Regulatory Compliance | Customer Experience |

| Technology Infrastructure | Service Delivery Channels |

| Capital Market Analysis | Product Innovation |

The relationship between upstream and downstream dynamics is crucial. Technological advancements and customer-centric approaches are changing how financial institutions operate. They are reshaping how they deliver value.

Aligning upstream and downstream elements is vital. It helps financial organizations stay competitive, responsive, and innovative in a fast-changing global market.

Trends in digital banking, embedded finance, and decentralized platforms

The world of finance is changing fast, thanks to new tech and what people want. Digital tools are making banking easier and more fun. This is shaking up old banking ways.

The global finance market is growing fast. Experts say it will grow even more in the future. Three big trends are changing how we think about money.

The Rise of Digital Banking

Digital banking is making banking easy and always available. People want to bank anytime, anywhere, using their phones or computers.

- Smartphone-based banking transactions increased by 65% in the past two years

- Mobile payment platforms experiencing exponential user adoption

- AI-powered personalized financial recommendations

Embedded Finance: Integrating Financial Services

Embedded finance is a new way to offer banking services. It lets companies add banking features to their apps and websites.

- E-commerce platforms offering instant credit

- Ride-sharing apps providing insurance products

- Retail applications with integrated payment solutions

Decentralized Platforms: Reimagining Financial Models

Decentralized finance uses blockchain to change banking. It offers safe, open banking without needing a middleman.

- Cryptocurrency transactions bypassing traditional banking systems

- Smart contracts enabling automated financial agreements

- Peer-to-peer lending platforms with reduced intermediation

As these trends grow, banks must keep up. They need to be quick to stay ahead in a tech-driven world.

Barriers involving legacy systems, regulation, and market trust

The financial services industry is facing big challenges that slow down its digital growth. These barriers make it hard for companies to update their tech and ways of working.

Old technology is a big problem for banks and financial firms. It holds them back from using the latest digital tools and ideas.

The Technology Bottleneck

Old systems cause trouble for companies. They:

- Need a lot of upkeep

- Make it hard to work with new digital tools

- Leave them open to security risks

- Make it hard to be flexible and quick

Regulatory Complexity

Financial rules are very complex and hard to follow. It takes a lot of money and tech to keep up with these rules.

Trust in the Digital Era

Keeping customer trust is key in digital finance. With cyber threats and privacy issues, banks must be very secure and open. They need to show they are trustworthy.

To get past these big hurdles, banks need to invest in new tech, follow rules well, and talk openly with customers.

Geopolitical shifts in financial hubs and regulatory arbitrage

The world of finance is changing fast, thanks to complex global politics. Financial centers are changing, creating new chances for smart financial moves.

Financial companies use a clever tactic called regulatory arbitrage. They look for places with easy rules to follow. This helps them save money and work better.

Emerging financial centers challenge traditional markets

New financial centers are competing with established ones.

Geopolitical tensions directly impact financial service strategies

Political conflicts around the world affect how financial services operate.

Regulatory environments become key competitive differentiators

The rules and regulations in different countries become important factors that set them apart from each other.

Finance is seeing big changes because of politics. Places like Singapore, Dubai, and Hong Kong are using special rules to draw in money and investments.

| Financial Hub | Regulatory Advantage | Global Ranking |

| Singapore | Innovative Fintech Regulations | Top 3 |

| Dubai | Free Zone Financial Incentives | Top 5 |

| Hong Kong | Crypto-Friendly Framework | Top 4 |

Now, financial companies must really get to know the global politics. They need to see how rules can help or hurt them in the big market.

Type segmentation: retail banking, investment services, and insurance

The financial services world is changing fast in retail banking, investment services, and insurance. Each area is finding new ways to meet customer needs and keep up with tech changes.

Financial companies are making big changes with digital tools and focusing on what customers want. This shows us how the market is moving.

Retail Banking: Digital Consumer Adaptation

Retail banking is going digital in a big way. Banks are creating mobile apps that offer:

- Personalized financial tools

- Real-time transaction tracking

- AI-powered spending insights

- Smooth experiences across different channels

Investment Services: Democratization Era

Investment services are becoming more accessible than ever. With robo-advisors and fractional investing, more people can get into the market.

Insurance: Insurtech Innovations

Insurance is getting a tech boost, changing how risks are assessed. Personalized coverage and smart underwriting are now common.

- Usage-based insurance models

- AI-powered risk evaluation

- Quick digital claims processing

- Microinsurance products

These changes show the financial services market’s focus on tech and customer needs.

Application segmentation: individuals, SMEs, and institutional clients

The world of finance has changed a lot. Now, companies use new tech to meet the needs of different groups. They make experiences that fit each client’s unique needs.

Financial institutions are changing how they serve different groups. They use new ways to solve problems:

- Individual consumers get banking that’s just for them.

- SMEs find solutions for their funding needs.

- Institutional clients get advanced investment plans.

Tailoring Financial Services for Individual Consumers

Now, finance focuses on making things personal. Mobile apps, AI advice, and easy-to-use sites are key. Banks and fintech offer tools for managing money, budgeting, and investing.

Addressing Financial Challenges for SMEs

Small and Medium Enterprises (SMEs) encounter unique financial obstacles. However, innovative solutions such as alternative lending and digital payments are proving to be beneficial. These resources simplify the process for businesses to access the funds they require.

Serving Institutional Clients

Finance for large institutions is becoming more complicated. They require improved risk management, data analysis, and investment strategies. Service providers are developing platforms that offer research, predictive tools, and financial management solutions.

Global trends in fintech, neobanking, and digital identity

The world of finance is changing fast, thanks to new tech and what people want. Fintech is making banking better for everyone, opening up new ways to manage money.

Big changes are happening in finance, with new tech taking on old banks. Neobanks are growing fast, giving people easier and more flexible banking options.

The Fintech Revolution: Disrupting Traditional Financial Services

Fintech startups are changing banking with new tech and simpler ways to do things. Some key changes include:

- AI-powered financial analytics

- Blockchain-based transaction systems

- Machine learning risk assessment tools

Neobanks: The Rise of Digital-Only Banking

Digital banks are making banking better by focusing on mobile and ease. They offer:

- 24/7 account management

- Lower transaction fees

- Instant financial insights

Digital Identity: The Foundation of Secure Financial Services

Digital identity technology is key to making finance safe and trustworthy. New solutions include:

| Technology Security Features Biometric Authentication | Facial recognition, fingerprint scanning |

| Blockchain Identity Verification | Decentralized, tamper-proof credentials |

Adding digital identity to finance is a big step towards safer, better banking for everyone around the world.

U.S. Innovation in Embedded Finance and AI-Based Investment

The United States is leading the way in financial innovation, revolutionizing our approach to money management. One of the significant advancements in this field is embedded finance, which allows non-financial companies to seamlessly integrate financial services into their products.

How AI is Transforming Wealth Management

Artificial Intelligence (AI) is also playing a crucial role in reshaping wealth management. With AI, intricate investment strategies that were once limited to a select few are now accessible to a broader audience. Cutting-edge technologies are further democratizing financial services, empowering individuals with tools like advanced analytics and machine learning.

Examples of Recent Innovations

Here are some examples of how embedded finance and AI are driving innovation in the industry:

- Embedded finance platforms now enable retailers to offer instant credit

- AI-powered robo-advisors provide personalized investment recommendations

- Machine learning algorithms analyze complex market trends in real-time

Key Developments Shaping the Innovation Landscape

Several key developments are shaping the future of financial innovation:

- Seamless financial integration across digital platforms

- Reduced barriers to sophisticated investment strategies

- Enhanced personalization of financial services

The Impact of Technology on Financial Accessibility

Technological advancements are making finance more accessible than ever before. AI investment tools are breaking down barriers for investors, providing them with resources and insights that were previously out of reach.

The U.S. is at the forefront of this movement, leveraging technology to create a more inclusive and efficient financial landscape.

Singapore's regulatory sandbox and global fintech leadership

Singapore is a leader in Asian financial innovation. It has become a global fintech hub. The city’s approach to technology is unique, setting it apart from traditional markets.

The key to Singapore’s fintech success is its regulatory sandbox. This sandbox is a controlled space for financial tech companies. It lets startups test new solutions with real customers under strict oversight.

What makes Singapore stand out in fintech include:

- Comprehensive support for digital banking licenses

- Robust cybersecurity infrastructure

- Strategic international partnerships

- Proactive government investment in technological ecosystems

The regulatory sandbox has drawn many international fintech companies. It has made Singapore a key hub for Asian financial innovation. Startups can try out new technologies while following strict rules.

| Fintech Focus Area | Key Achievements | Global Ranking |

| Digital Banking | 5 new digital bank licenses | Top 3 Global Fintech Hub |

| Blockchain Innovation | 40+ blockchain pilot projects | Leading Asian Blockchain Ecosystem |

| Insurtech Development | Accelerated digital insurance platforms | Regional Innovation Leader |

Singapore’s ecosystem balances innovation with careful regulation. This makes it stand out in the global fintech world.

Switzerland's Wealth Management Modernization and Crypto Custody

Switzerland is changing its famous Swiss wealth management by using new digital technologies. The country’s financial world is quickly changing. It’s becoming a world leader in handling digital assets and using blockchain in finance.

The Swiss financial world is finding new ways to mix digital assets with old wealth management methods. Important steps include:

- Building advanced blockchain systems

- Creating strong rules for digital assets

- Starting special crypto custody platforms

More and more institutional investors are choosing Switzerland for its new approach. The country’s strong financial security is a big plus. Crypto custody solutions are key to Switzerland’s financial plan. They help mix old and new investment ways smoothly.

Rules for blockchain in finance have been made carefully. They keep high standards while allowing for new tech. Swiss banks are leading in digital asset management. They mix new tech with careful risk management.

Switzerland’s focus on digital change keeps it at the top of global finance. It draws both big and small investors looking for top-notch, safe financial services.

Future trajectory in cross-border services and digital asset integration

The world of finance is changing fast, thanks to new tech and market shifts. Cross-border financial services are growing a lot. They’re breaking down old barriers and opening up new chances for global money dealings.

Financial companies are quickly getting into digital assets. They see how these can change old money ways. Digital assets are a new and exciting area for global finance.

The Evolution of Cross-Border Financial Services

Today’s cross-border finance has seen big changes:

- More digital connections

- Lower costs for transactions

- Faster payments

- Better ways to manage risks

Digital Assets: More Than Just Cryptocurrencies

Digital assets encompass more than just cryptocurrencies. Tokenized securities are revolutionizing the finance industry by introducing increased liquidity and accessibility for investors around the globe.

Regulatory Challenges in a Borderless Financial World

Regulating global finance with digital assets is tough. Key issues include:

- Setting global rules

- Keeping investors safe

- Stopping financial crimes

- Keeping up with innovation and risk

As finance gets more connected, we need to work together. We must create strong, flexible rules. These rules should support new ideas and keep finance safe.

Competitive dynamics in global financial ecosystems

The financial world is changing fast, with old ways facing new challenges. Digital players are shaking things up. This has made banks and financial services rethink their plans.

- Traditional financial institutions

- Agile fintech startups

- Emerging big tech companies in finance

- Digital-first banking platforms

Traditional Financial Institutions vs. Fintech Disruptors

Traditional banks are feeling the heat to improve their digital capabilities. Fintech disruption introduces innovative concepts that challenge the banking industry. Agile and nimble fintech companies leverage advanced technology to provide convenient and cost-effective services.

Key Players:

-

JPMorgan Chase — USA

-

Bank of America — USA

-

Wells Fargo — USA

-

Citigroup — USA

-

Goldman Sachs — USA

-

Morgan Stanley — USA

-

HSBC — UK

-

Barclays — UK

-

UBS — Switzerland

-

Credit Suisse — Switzerland

Collaborative Models and Strategic Partnerships

Many banks recognize the potential of technology and want to collaborate. They are partnering with fintech startups. This combination of traditional and innovative approaches results in more effective and intelligent financial services.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Financial Services Market Report |

| Base Year | 2024 |

| Segment by Type |

· Retail Banking · Investment Services · Insurance |

| Segment by Application |

· Individuals · SMEs · Institutional Clients |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The financial services market is changing fast, with big growth expected. It’s set to hit $62.08 trillion by 2033, growing at 7.1% each year. This growth is driven by digital changes that are shaking up the industry.

Stakeholders need to understand what’s driving these changes. Digital platforms, AI, and new tech are changing how services are delivered. Banks must invest in new tech and adapt to stay ahead of fintech startups.

The future of finance depends on using new tech while following rules. Places like Singapore and Switzerland show how innovation can boost the financial scene. Companies that focus on customer needs, use data, and go digital will thrive.

The world’s economy is always changing, and finance must keep up. Stakeholders need to watch tech trends, rules, and what customers want. By staying flexible and innovative, financial services can grow and succeed.

Global Financial Services Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Financial Services Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Financial Services Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Financial Services Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Financial Services Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Financial Services Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Financial Services Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Financial ServicesMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the financial services market by 2025?

The financial services market is expected to grow to about $35.86 trillion by 2025. This growth is driven by digital transformation and new fintech solutions. Key markets like the United States, Singapore, and Switzerland are leading this change.

How are digital banking trends changing the financial services landscape?

Digital banking is changing how we bank. It brings mobile banking, tools for managing money, and easy digital experiences. These changes focus on making banking faster, more convenient, and accessible to everyone.

What is embedded finance?

Embedded finance is a new way of banking. It adds financial services to non-banking platforms. This lets companies in different fields offer banking services right in their own spaces.

What challenges do financial institutions face in digital transformation?

Banks face big challenges in going digital. They struggle with old systems, need a lot of money for new tech, and deal with complex rules. They also have to keep customers’ trust as cyber threats grow.

How are neobanks disrupting traditional banking?

Neobanks are new, digital banks that offer better services. They are faster, cheaper, and easier to use. They challenge old banks by providing better digital experiences and new financial products.

What role do geopolitical factors play in financial services?

Politics has a significant impact on banking. It influences the emergence of new financial centers, creates opportunities for regulatory evasion, and transforms the global operations of banks. Additionally, politics affects trade and how banks engage with international markets.

How are AI and machine learning transforming financial services?

AI and machine learning are changing banking. They help with smart investments, personal advice, and spotting fraud. They make banking smarter and more efficient for everyone.

Why is digital identity important in financial services?

Digital identity is key for safe banking. It uses new tech like biometrics and blockchain to check who you are. This makes banking safer and easier for everyone.

How are financial services adapting to different client segments?

Banks are creating products tailored for specific groups. They offer apps for individuals, loans for small businesses, and intricate services for large clients. This approach makes banking more personalized and efficient.

What emerging trends are shaping the future of cross-border financial services?

Cross-border banking is getting better with new tech. It’s accepting digital assets, improving remittances, and making international banking smoother. These changes help people and businesses move money across borders easily.