NPL Management Solution Market to Surpass $2.1 Billion by 2025: Strategic Reforms in Italy, China, and the U.K.

Discover how the NPL Management Solution Market is growing globally, driven by strategic reforms in Italy and China. Market value expected to exceed $2.1B by 2025.

- Last Updated:

NPL Management Solution Market in Q1 and Q2 of 2025

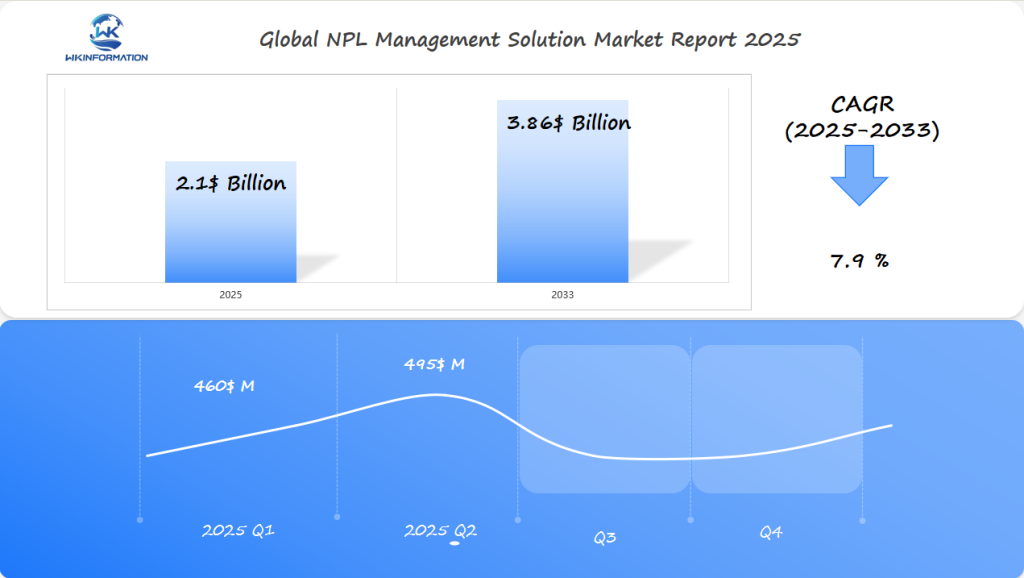

The NPL Management Solution market is projected to reach $2.1 billion in 2025, with a CAGR of 7.9% from 2025 to 2033. In Q1 2025, the market size will be around $460 million, increasing to $495 million in Q2. This growth is driven by rising non-performing loans globally, especially in Europe and Asia, and the demand for AI-powered debt collection solutions.

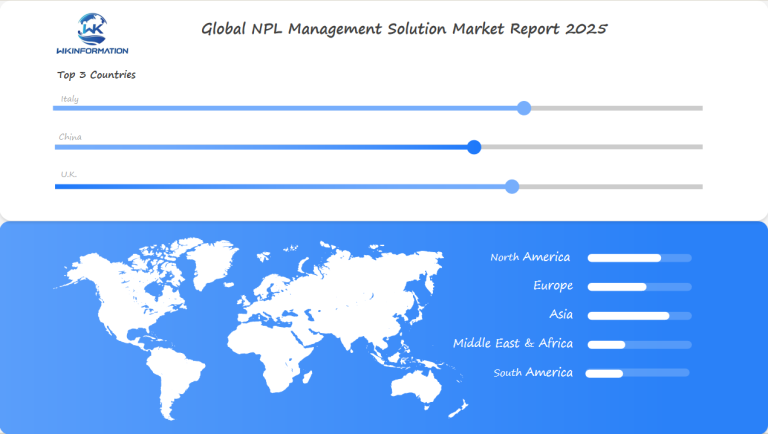

Key regions like the U.K. and China are investing in automated NPL management to improve efficiency and compliance. Italy’s financial reforms also push for more tech-driven NPL solutions. With more financial institutions adopting machine learning, the industry is set to enhance recovery rates and reduce collection timeframes. Additionally, as global regulators enforce stricter non-performing loan management standards, companies are under increased pressure to modernize their debt recovery processes.

Key Takeaways

- NPL Management Solution Market expected to reach $2.1 billion by 2025

- Strategic reforms in Italy, China, and the U.K. driving market growth

- Advanced technologies transforming loan recovery processes

- Digital solutions increasing operational efficiency for financial institutions

- AI and data analytics playing crucial roles in NPL management

Upstream and Downstream Flows in the NPL Ecosystem

The NPL ecosystem is a complex web of financial interactions. It involves the management of non-performing loans through key stages. For financial institutions, understanding these flows is key to finding effective solutions.

Upstream Flows

Upstream flows start with the creation of loans and early credit checks. These steps are crucial in figuring out the risk and performance of loans. They help decide if a loan might become non-performing later on.

- Initial credit evaluation

- Risk profiling

- Loan underwriting mechanisms

Downstream Flows

Downstream flows deal with handling non-performing loans. Financial institutions use different strategies to reduce losses and get back what’s owed.

| Upstream Flow Components | Downstream Flow Components |

| Credit scoring | Debt restructuring |

| Risk assessment | Asset recovery |

| Loan origination | Portfolio management |

Managing NPL ecosystem flows well needs advanced tools and strategies. Financial institutions must link upstream and downstream processes smoothly. This helps avoid big economic problems. Technology is changing how we handle these complex flows. It helps with better risk checks and faster solutions.

Trends in digital debt resolution, AI credit scoring, and banking automation

The financial world is changing fast thanks to new tech. Digital debt resolution, AI credit scoring, and banking automation are changing how loans are managed and credit risks are seen.

Financial tech is changing old ways of handling loans. AI credit scoring is a big change for banks looking for better ways to assess risks.

Emerging Technologies in NPL Management

Now, NPL management uses advanced digital tools. These tools make complex tasks easier. They bring many benefits:

- Real-time data analysis

- Predictive risk modeling

- Enhanced decision-making capabilities

- Reduced operational costs

Impact of AI on Credit Risk Assessment

AI credit scoring gives deep insights into how people borrow money. It looks at huge amounts of data to:

- Spot potential default risks better

- Make custom risk profiles

- Lessen human bias in credit checks

Automation in Banking Processes

Banking automation uses smart algorithms and learning machines. Digital debt resolution tools help banks manage big loan portfolios well.

Experts say banking automation will keep getting better. It will help manage non-performing loans even better.

Challenges in the Non-Performing Loan Management Solution Market

The Non-Performing Loan (NPL) Management Solution Market faces big challenges. These include data privacy, legal complexity, and market opacity. These barriers make it hard for financial institutions to improve their NPL strategies.

Companies must deal with a complex world of rules and protect private financial info. The mix of tech and finance management requires smart solutions.

Data Privacy Challenges in NPL Management

NPL management deals with a lot of personal and financial data. The main privacy issues are:

- Keeping individual financial records safe

- Making sure data is sent securely

- Following global data protection laws

- Using strong cybersecurity

Navigating Legal Complexities

Legal rules for NPL management differ a lot from place to place. Financial firms need to create detailed plans that cover:

- Following regulatory rules

- Dealing with legal issues across borders

- Rules for debt collection

- Ways to reduce risks

Addressing Market Opacity Issues

Market opacity is a big problem in NPL management. Clear valuation and open communication are key for success. Financial companies need advanced analytics and detailed reports to solve this issue.

New tech like artificial intelligence and blockchain can help. They promise to make things clearer and make NPL management easier.

Geopolitical factors influencing banking reform and credit crises

The financial landscape is constantly evolving, and these changes have a direct impact on how we manage non-performing loans (NPLs). Key factors such as banking reform and credit crises play a significant role in shaping this dynamic.

Challenges faced by banks today

Today’s banks are grappling with substantial challenges brought about by shifts in the global economy. The combination of banking reform and credit crises creates an environment where staying on top of NPLs becomes increasingly difficult.

The need for adaptive solutions

In order to navigate this complex landscape, solutions must be agile and adaptable. They need to evolve rapidly in response to market demands, ensuring that banks can effectively address the issue of NPLs.

Banking Reforms Transforming NPL Strategies

New banking rules have changed how we deal with NPLs. These changes include:

- More rules to follow

- Tighter money rules

- Clearer loan management

- Better ways to avoid risks

Credit Crises Driving Market Innovations

Credit problems have led to new ways to handle NPLs. Banks are spending a lot on:

- AI for credit checks

- Systems to check risks fast

- Online ways to solve debt

- Tools to understand loan portfolios

Type segmentation: software platforms, advisory services, and recovery tools

The Non-Performing Loan (NPL) management market offers various solutions to tackle financial recovery challenges. These tools help banks and financial institutions deal with debt more efficiently.

Financial institutions use three main types of NPL management solutions. These are:

- Software platforms for automated tracking

- Advisory services for strategic guidance

- Recovery tools for debt collection

Software Platforms: The Digital Backbone of NPL Management

Software platforms are key in NPL management. They help track, analyze, and manage non-performing assets accurately. Advanced algorithms in these platforms offer real-time insights into loan performance and recovery strategies.

Advisory Services: Strategic Expertise in Loan Resolution

Advisory services are crucial for developing effective strategies to resolve non-performing loans (NPLs). Financial experts leverage their extensive understanding of the market to assist institutions in restructuring debt. This guidance plays a significant role in minimizing losses and enhancing recovery results.

Recovery Tools: Precision in Debt Collection

Recovery tools are advanced mechanisms for asset retrieval. They use data analytics, legal frameworks, and negotiation strategies to boost debt collection efficiency. By using these tools, financial institutions can significantly increase their NPL recovery rates.

Application segmentation: commercial banks, asset management firms, and regulators

The Non-Performing Loan (NPL) management solution market is key for financial strategies. Different groups tackle NPL challenges with their own views and tools.

Financial institutions now see the need for better NPL management. They aim to reduce risks and improve asset value.

NPL Management in Commercial Banks

Commercial banks face big challenges in managing non-performing loans. They use:

- Advanced risk assessment technologies

- Digital debt resolution platforms

- AI-powered credit scoring systems

Asset Management Firms and NPL Portfolios

Asset management firms tackle NPLs with strategic investments and special recovery methods. They use data analytics to check and fix troubled loan portfolios.

Regulatory Oversight in NPL Management

Regulators play a crucial role in establishing regulations for managing non-performing loans (NPLs). They implement stringent guidelines to promote transparency and mitigate financial risks.

With the advent of new technologies, commercial banks, asset management firms, and regulators are reshaping the landscape of NPL management.

Global shift toward tech-enabled loan servicing

The financial world is changing fast, thanks to loan servicing technology. Banks and financial groups are quickly adopting digital tools. They want to make their work easier and improve how they serve customers.

Loan servicing is getting a big update with tech. This new way uses the latest tech to make lending better. It makes the process more efficient, clear, and quick for everyone involved.

Adoption of Technology in Loan Servicing

Financial groups are using new tech to change how they handle loans. They’re adding:

- Artificial intelligence for smart predictions

- Machine learning for better risk checks

- Cloud-based systems for easy management

- Automated systems for keeping up with rules

Benefits of Tech-Enabled Solutions

Using tech in loan servicing brings big benefits:

- Lower costs for running the business

- More accurate loan handling

- Better service for customers

- Quick updates and reports

Case Studies of Successful Implementations

Many banks have seen great success with tech in loan servicing. JPMorgan Chase and Wells Fargo have built advanced digital tools. These tools have made managing loans much easier for them.

The move to digital in loan servicing is more than a trend. It’s a big change in how financial services are delivered. It promises better efficiency and happier customers.

Italy's strategic push to reduce legacy NPL ratios

The Italian banking sector has seen a big change in dealing with its tough NPL ratios. For years, Italy had one of the highest non-performing loan portfolios in Europe. This put a lot of pressure on its banks.

The government’s big plan to fix the banks has been key. They’ve worked hard to make the financial system better. They’ve done this by:

- Starting strong NPL reduction programs

- Updating the banking rules

- Improving how they manage risks

- Making it easier to sell off bad assets

Government Initiatives Driving Change

Italy has made significant efforts to make its banking system more transparent and efficient. The government has implemented plans to assist banks in quickly eliminating non-performing loans. Additionally, they have introduced new methods for managing debt.

Market Impact and Transformation

These changes have had a significant effect on the market. Banks are now using new technology to manage bad loans. Digital platforms and AI-driven analytics assist them in identifying and resolving credit risks.

Italy’s approach to addressing NPL ratios has not only benefited its banks but has also inspired other countries to find solutions for their own issues. Financial experts globally are closely examining Italy’s success.

China's New Asset Management Platforms and Fintech Involvement

China has made significant changes in how it deals with non-performing loans (NPLs). New asset management platforms are now playing a crucial role in addressing NPL issues, and they are leveraging fintech to streamline the process of debt recovery.

China’s approach to managing NPLs demonstrates a strategic plan to mitigate financial risks. Fintech companies in China have developed innovative technologies that facilitate more effective solutions for dealing with debt.

Innovative Approaches to NPL Resolution

Some big changes in China’s NPL market include:

- Advanced data analytics for credit risk assessment

- AI-powered loan portfolio management

- Digital platforms for asset recovery

- Integrated financial technology solutions

Rise of Asset Management Platforms

Chinese asset management platforms have significantly transformed the process of resolving non-performing loans (NPLs). These platforms have brought about several key innovations, including:

- Real-time debt tracking systems

- Machine learning-powered valuation models

- Comprehensive risk management tools

- Seamless digital transaction processes

The Strategic Role of Fintech

Fintech has transformed how China deals with non-performing loans (NPLs). Chinese financial institutions now leverage advanced technology to mitigate financial risks and enhance asset recovery strategies.

With the help of technology, NPL management in China has become more transparent, efficient, and data-driven. This advancement positions China as a leader in the global fintech landscape.

U.K.'s restructuring and private equity entry into NPL recovery

The United Kingdom’s banking sector has seen big changes lately. Efforts to restructure have changed how non-performing loans (NPLs) are managed. Private equity firms are now big players in fixing these loans, using new ways to tackle tough financial problems.

U.K. banking reforms have made a special place for private equity in NPL recovery. This is thanks to a few key things:

- More rules for banks

- More bad loans

- New tech for solving debt

Banking Sector Transformation

Banks are teaming up with private equity to handle NPLs better. This teamwork is great for getting rid of old debt and making bank balance sheets healthier.

| Strategy | Impact | Recovery Rate |

| Direct Portfolio Acquisition | Buying high-value NPLs | 65-75% |

| Debt Restructuring | Settling debts through talks | 50-60% |

| Technology-Driven Resolution | Using tech for quick recovery | 70-80% |

Private Equity’s Strategic Approach

Private equity uses smart analytics and data-driven strategies to get the most out of NPL recovery. They mix deep financial knowledge with the latest tech, making it easier to solve NPLs.

The U.K. banking reforms keep helping, making it easier to fix NPLs. With private equity playing a bigger role, the market is set to keep getting better.

Future growth in real-time valuation and digital servicing models

The Non-Performing Loan (NPL) management world is changing fast. New tech is leading the way. Banks are now using real-time NPL valuation to improve how they handle bad loans.

Digital models are changing how banks manage loans. New tech platforms help track bad assets better and faster.

Advancements in Real-Time NPL Valuation

- AI-powered predictive analytics for accurate asset assessment

- Machine learning algorithms enhancing valuation precision

- Automated risk scoring techniques

The Evolution of Digital Servicing Models

Digital models are a significant advancement. Banks are leveraging smart technology to:

- Process data quickly

- Manage risks more effectively

- Facilitate easier recovery

Key competitors in distressed asset management

The NPL market players have changed the game in distressed asset management. They’ve done this with smart strategies and new tech. Knowing who’s out there helps us see what the future holds.

Top players in distressed asset management have their own ways of tackling non-performing loans. Their methods show they really get the complex world of finance.

Key Players:

-

Deloitte — USA

-

PwC — UK

-

Ernst & Young (EY) — UK

-

KPMG — Netherlands

-

Grant Thornton — UK

-

BDO — Belgium

-

Crowe Horwath — USA

-

CliftonLarsonAllen — USA

-

Link Asset Services — UK

-

Accenture — Ireland

Competitive Differentiation Strategies

Each major player has its own advantage to stand out:

- Technology Integration: Uses AI for credit checks

- Risk Management: Uses smart analytics for better loan recovery

- Global Network: Handles deals across borders

- Regulatory Compliance: Keeps up with financial rule changes

Market Share Dynamics

The market is divided, with the biggest players taking a significant portion. They achieve this through their expertise and innovative technology.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global NPL Management Solution Market Report |

| Base Year | 2024 |

| Segment by Type |

· Software Platforms · Advisory Services · Recovery Tools |

| Segment by Application |

· Commercial Banks · Asset Management Firms · Regulators · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The NPL market is changing fast, thanks to new tech and smart strategies. Digital innovations are changing how banks handle bad loans. This opens up new chances for growth and better efficiency.

What’s driving growth in NPL management are smart AI, machine learning, and big data tools. Banks around the world are spending on top-notch software. This helps them get back lost money and cut down risks.

Experts predict the NPL market will grow a lot globally. Countries like Italy, China, and the UK will lead in tech progress. New fintech, better rules, and advanced risk tools will shape the market’s future.

For those in the industry, key advice is to focus on digital change, protect data, and use new tech. Companies that use the latest NPL tools will do well in the financial world. They’ll be ready to grab new chances in the market.

Global NPL Management Solution Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: NPL Management Solution Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- NPL Management Solution Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global NPL Management Solution Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: NPL Management Solution Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: NPL Management Solution Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: NPL Management Solution Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of NPL Management SolutionMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market size for NPL Management Solutions by 2025?

The NPL Management Solution Market is expected to reach $2.1 billion by 2025. This growth is driven by strategic changes in markets such as Italy, China, and the UK.

How do upstream and downstream flows impact NPL management?

Upstream and downstream flows are key in NPL management. They affect the whole loan cycle, from start to end. They show how financial players are connected and can boost management if worked well together.

What technologies are transforming NPL management?

New tech like digital debt solutions, AI credit scoring, and banking automation are changing NPL management. They make it more efficient, cut costs, and help make better decisions.

What are the main challenges in the NPL Management Solution Market?

The major challenges include:

- Data privacy concerns

- Complex laws and regulations

- Protection of market secrets

- Strict rules and compliance requirements

These challenges can hinder growth and require innovative solutions.

How do geopolitical factors influence the NPL Management Solution Market?

Global events like banking reforms and credit crises shape NPL demand. They change market trends and push for new ideas in the sector.

What types of offerings exist in the NPL Management Solution Market?

The market offers software, advisory, and recovery tools. Each meets different needs in NPL management.

Which sectors primarily use NPL management solutions?

Commercial banks, asset managers, and regulators mainly use NPL solutions. Each has its own needs and challenges.

What is the global trend in loan servicing technology?

There’s a significant shift towards technology in loan servicing. Banks are adopting new technologies to streamline processes, reduce costs, and enhance customer service.

How is Italy addressing its NPL challenges?

Italy is tackling NPLs with reforms and government plans. This is boosting demand for new solutions and opening up market chances.

What makes China’s NPL market unique?

China’s NPL market is unique because of new asset platforms and fintech growth. This offers special opportunities for solution providers.

What are the future growth prospects for NPL management solutions?

Growth will come from real-time valuations, digital models, and tech advancements. These will make NPL management better and more efficient.

Are there specific technological advancements improving NPL management?

Yes, advancements like AI scoring, automated debt tools, and real-time valuations are changing NPL management. They’re making old ways better.