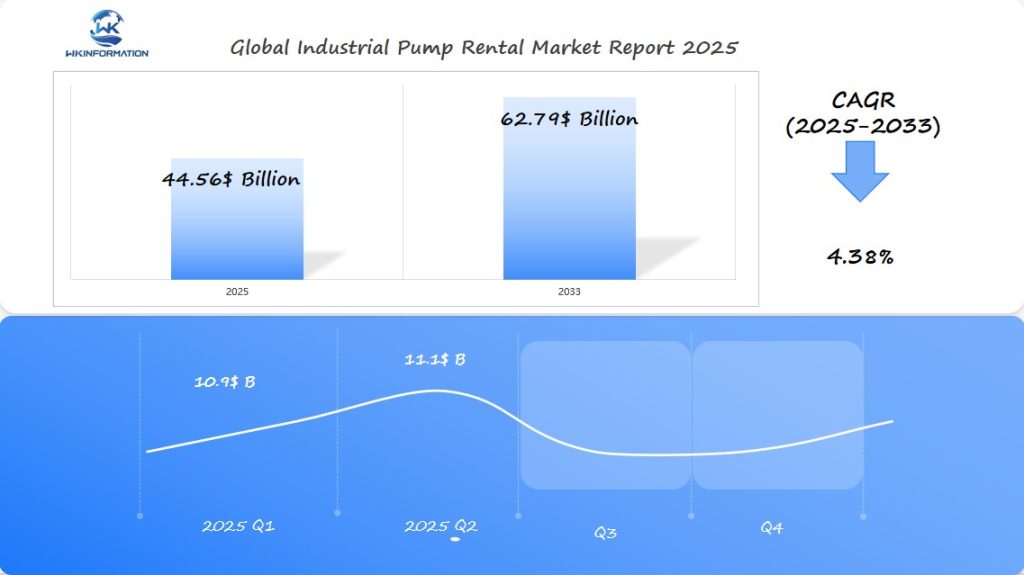

Industrial Pump Rental Market Forecast to Hit $44.56 Billion by 2025: Growth Accelerates in the U.S., Germany, and Australia

The Industrial Pump Rental Market is projected to reach $44.56 billion by 2025. This significant growth is being driven by increasing demand in key regions such as the U.S., Germany, and Australia.These countries are experiencing rapid industrial expansion and infrastructure development, which requires reliable and efficient pump rental solutions.

- Last Updated:

Industrial Pump Rental Market Forecast for Q1 and Q2 2025

The industrial pump rental market is set to reach $44.56 billion by 2025, with a CAGR of 4.38% from 2025 to 2033. The market is expected to see significant demand across various industries, particularly in the U.S. where the oil and gas sector remains a major driver.

Q1 2025 revenues are expected to hit $10.9 billion, rising slightly to $11.1 billion in Q2 due to increased construction and infrastructure projects. In Germany, the rise in environmental regulations has spurred demand for rental pumps for water treatment and waste management, while Australia’s mining industry is also a critical growth segment.

The rental model offers flexibility and cost savings, making it increasingly popular across diverse sectors such as chemicals, utilities, and industrial applications.

Upstream and Downstream Forces in the Pump Rental Value Chain

The industrial pump rental sector is subject to a complex interplay of upstream and downstream forces within its value chain. These forces significantly influence the market dynamics and overall growth of the industry.

Analyzing the Value Chain

Analyzing the value chain of the pump rental industry involves understanding the various stakeholders and components that contribute to its functioning.

The pump rental value chain comprises several key elements, including manufacturers, rental companies, logistics providers, and end-users. Each of these stakeholders plays a vital role in ensuring the smooth operation of the industry.

Understanding Upstream and Downstream Dynamics

Upstream forces in the pump rental value chain include manufacturers and suppliers of pumps, as well as logistics and transportation services. These components are crucial for ensuring the availability and delivery of pumps to rental companies.

Downstream forces, on the other hand, involve the rental companies themselves, as well as the end-users of the pumps, such as construction, oil & gas, and mining industries. The demand from these end-users drives the rental market and influences the types of pumps that are rented.

| Category | Components | Role in the Value Chain |

| Upstream Forces | Manufacturers, Suppliers, Logistics Providers | Supply and delivery of pumps, maintenance services |

| Downstream Forces | Rental Companies, End-users (Construction, Oil & Gas, Mining) | Renting pumps, demand generation, industry-specific applications |

The interplay between upstream and downstream forces in the pump rental value chain is complex and multifaceted. Understanding these dynamics is crucial for stakeholders to navigate the market effectively.

Trends Driving Industrial Temporary Equipment Adoption

The increasing adoption of industrial temporary equipment is being driven by a combination of technological advancements and market trends. This shift is particularly evident in the pump rental sector, where companies are leveraging temporary equipment to meet fluctuating demand.

Current Trends in Temporary Equipment Rental

One of the primary trends driving the adoption of industrial temporary equipment is the increasing need for flexibility and scalability in operations. Companies are moving away from owning equipment outright and instead opting for rental services that allow them to scale up or down as needed.

Technological advancements are also playing a crucial role in this trend. Modern temporary equipment is often equipped with advanced technologies that improve efficiency, reduce energy consumption, and enhance overall performance.

The rise of the sharing economy is another factor contributing to the growth of the temporary equipment rental market. This economic model encourages the sharing and renting of equipment, reducing waste and promoting more efficient use of resources.

The current trends in temporary equipment rental are also influenced by the need for sustainability and environmental responsibility. Companies are increasingly opting for rental equipment that is more energy-efficient and produces fewer emissions.

These trends are expected to continue driving the adoption of industrial temporary equipment in the coming years, with the pump rental sector being a key beneficiary of this growth.

Challenges in Scaling Rental Services Across Industries

As the demand for rental services grows, companies encounter several obstacles in expanding their operations across industries. The industrial equipment rental market is characterized by diverse customer needs, varying industry standards, and differing regulatory requirements, making it challenging to scale services effectively.

Overcoming Scaling Challenges

One of the main challenges in scaling rental services is maintaining a consistent level of quality across different locations and industries. Companies must invest in strong training programs for their staff to ensure that they can meet the diverse needs of their customers.

Another major challenge is managing logistics and supply chains in various regions. This requires implementing advanced inventory management systems and developing strategic partnerships with local suppliers.

Strategies for Effective Scaling

To overcome the challenges associated with scaling rental services, companies can adopt several strategies:

- Investing in technology to streamline operations and improve customer service

- Developing industry-specific solutions to cater to unique customer needs

- Building a strong network of local partners to enhance logistics and supply chain management

Effective scaling also requires a deep understanding of the market dynamics and customer needs in different industries. Companies must conduct thorough market research and analysis to identify opportunities and challenges.

| Industry | Challenges | Strategies for Scaling |

| Construction | Managing equipment inventory, logistics | Investing in inventory management systems, partnering with local suppliers |

| Oil & Gas | Regulatory compliance, equipment durability | Developing industry-specific equipment, ensuring regulatory compliance |

| Mining | Equipment reliability, maintenance | Implementing robust maintenance programs, investing in reliable equipment |

By understanding the challenges and adopting effective strategies, companies can successfully scale their rental services across industries, enhancing their competitiveness and customer satisfaction.

Impact of Geopolitical Factors on Equipment Deployment

As geopolitical landscapes evolve, the industrial equipment rental sector must adapt its deployment strategies. Geopolitical factors, including trade policies, sanctions, and regional conflicts, significantly influence the operational dynamics of equipment rental companies.

The complexity of geopolitical tensions can disrupt supply chains, affecting the timely delivery of equipment. For instance, sanctions imposed on certain countries can limit the availability of specific types of equipment, thereby impacting rental services.

Geopolitical Influences on Equipment Rental

Geopolitical influences can manifest in various ways, such as changes in trade policies that affect the cost and availability of rental equipment. Companies operating in multiple regions must navigate these challenges to maintain their service levels.

Key geopolitical factors influencing equipment rental include:

- Trade tariffs and agreements

- Regional conflicts and security concerns

- Economic sanctions and their implications on supply chains

Understanding these factors is crucial for companies to develop resilient deployment strategies. By analyzing geopolitical trends, businesses can better anticipate potential disruptions and plan accordingly.

Market Segmentation: Centrifugal, Submersible, and Positive Displacement Pumps

The rental market for industrial pumps is divided into several main categories: centrifugal, submersible, and positive displacement pumps. This division is important because it helps rental companies meet the different needs of various industries.

Types of Pumps in the Rental Market

The industrial pump rental market offers a variety of pump types, each designed for specific applications and industries. Understanding these pump types is essential for selecting the right equipment for temporary needs.

Centrifugal Pumps

Centrifugal pumps are widely used in industries that require high-flow rates and low-to-medium pressure applications. They are ideal for water treatment, cooling systems, and other applications where a high volume of fluid needs to be moved.

Submersible Pumps

Submersible pumps are designed to operate underwater and are commonly used in construction, mining, and wastewater management. Their ability to function submerged in water makes them invaluable for dewatering applications.

Positive Displacement Pumps

Positive displacement pumps are known for their ability to handle high-pressure applications and are often used in industries such as oil and gas, chemical processing, and food production. They provide a consistent flow rate regardless of the pressure.

The diversity in pump types allows industries to rent equipment that is tailored to their specific needs, enhancing operational efficiency and reducing costs.

Use Cases Driving Pump Rentals in Construction, Oil & Gas, and Mining

The demand for pump rentals is increasing in major industries like construction, oil & gas, and mining, driven by specific use cases. These sectors need pumps for various purposes, including dewatering, irrigation, fluid transfer, and pressure testing.

Industry-Specific Use Cases

Construction Industry

In the construction industry, pump rentals are crucial for:

- Dewatering sites

- Managing wastewater

- Supplying water for concrete mixing and other construction activities

The flexibility of renting pumps allows construction companies to adapt to changing project requirements without the long-term commitment of purchasing equipment.

Oil & Gas Sector

The oil & gas sector relies heavily on pump rentals for various operations, including:

- Drilling

- Completion

- Production

Rented pumps are used for transferring fluids, managing wellhead pressure, and handling produced water. The use of rental pumps in this sector is driven by the need for high-performance, reliable equipment that can withstand harsh operating conditions.

Mining Industry

In mining, pump rentals are essential for:

- Dewatering mines

- Managing tailings

- Supplying water for mineral processing

The mining industry benefits from renting pumps due to the ability to scale equipment according to operational needs, reducing capital expenditure and maintenance costs.

Some of the key benefits of pump rentals in these industries include:

- Flexibility: Renting pumps allows companies to adjust their equipment according to changing project demands.

- Cost-effectiveness: Pump rentals reduce the need for capital expenditure on equipment, lowering operational costs.

- Access to specialized equipment: Rental companies provide access to a wide range of pump types and sizes, including specialized pumps for specific applications.

- Maintenance and support: Rental providers typically offer maintenance and technical support, minimizing downtime and ensuring continuous operation.

By leveraging pump rentals, companies in the construction, oil & gas, and mining industries can enhance their operational efficiency, reduce costs, and improve their bottom line.

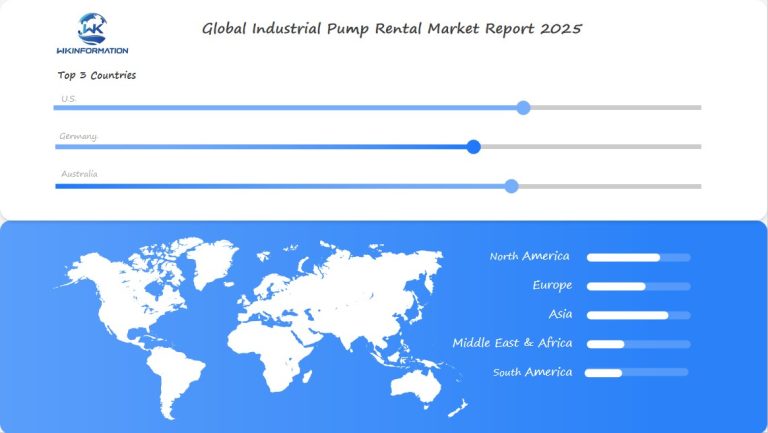

Regional Insights in the Industrial Pump Rental Sector

Understanding regional market nuances is essential for stakeholders in the industrial pump rental industry.

North America: Leading the Way

North America remains a dominant player in the industrial pump rental sector. The region’s robust industrial activities, coupled with a growing emphasis on infrastructure development, drive the demand for rental pumps. Key industries such as oil and gas, construction, and mining significantly contribute to this growth.

Europe: Adapting to Sustainability Trends

In Europe, the industrial pump rental market is witnessing a shift towards sustainability. With stringent environmental regulations and a focus on reducing carbon footprints, many industries are opting for energy-efficient pump solutions. This trend presents an opportunity for rental companies to offer eco-friendly pump options to their clients.

Asia-Pacific: Rapid Expansion

The Asia-Pacific region is experiencing rapid growth in the industrial pump rental sector. Countries like India and China are witnessing a surge in industrialization, leading to increased demand for pumps across various applications. Additionally, ongoing infrastructure projects in these countries further fuel the need for rental pumps.

Middle East and Africa: Untapped Potential

The Middle East and Africa regions hold untapped potential for the industrial pump rental market. While these areas have traditionally relied on purchasing pumps outright, there is a growing recognition of the benefits of renting equipment. As industries in these regions expand, rental companies can play a crucial role in providing flexible and cost-effective pumping solutions.

Latin America: Overcoming Challenges

In Latin America, the industrial pump rental sector faces challenges such as economic volatility and fluctuating currency rates. However, with increasing investments in sectors like mining and construction, there is still potential for growth. Rental companies operating in this region must navigate these challenges while offering competitive pricing and reliable service to attract customers.

Regional Market Analysis

A closer look at various regions reveals distinct trends and growth patterns in the industrial pump rental sector.

North America, with its robust oil and gas industry, has seen a considerable demand for industrial pumps. Similarly, the Asia-Pacific region, driven by rapid industrialization and infrastructure projects, is emerging as a significant market for pump rentals.

Key Drivers of Industrial Pump Rental Markets

The following table summarizes the key drivers of industrial pump rental markets in different regions:

| Region | Key Drivers |

| North America | Oil & Gas, Construction |

| Asia-Pacific | Infrastructure Projects, Industrialization |

| Europe | Industrial Manufacturing, Water Management |

Growth Prospects in Regional Industrial Pump Rental Markets

The growth prospects in regional industrial pump rental markets are as follows:

- North America: Moderate Growth

- Asia-Pacific: High Growth

- Europe: Stable Growth

The regional insights into the industrial pump rental sector highlight the importance of understanding local market dynamics. By analyzing these trends, stakeholders can make informed decisions about investments and resource allocation.

Furthermore, the growth prospects in regions like Asia-Pacific present opportunities for companies to expand their operations and diversify their portfolios.

U.S. Market: Aging Infrastructure and Emergency Response Boost Demand

The U.S. is experiencing a significant rise in pump rental demand, mainly due to its aging infrastructure and the need for quick emergency responses.

The country’s aging infrastructure is a major issue, with many water and wastewater systems in urgent need of repair or replacement. This has resulted in a greater dependence on pump rentals to control water flow and avoid system breakdowns.

U.S. Market Analysis

The U.S. pump rental market is driven by the need for temporary solutions to infrastructure challenges. Pump rentals offer a flexible and cost-effective way to manage water and wastewater during emergencies or maintenance.

Key Drivers:

- Aging infrastructure

- Increasing need for emergency response

- Flexibility and cost-effectiveness of pump rentals

The demand for pump rentals is expected to continue growing as the U.S. addresses its infrastructure challenges.

| Region | Demand for Pump Rentals | Primary Drivers |

| Northeast | High | Aging infrastructure, emergency response |

| West Coast | Moderate | Infrastructure projects, emergency response |

| South | High | Hurricane response, infrastructure challenges |

U.S. pump rental market demand

The regional demand for pump rentals varies, with areas prone to natural disasters or with aging infrastructure showing the highest demand.

The future of the U.S. pump rental market looks promising, driven by the ongoing need for infrastructure repair and emergency response measures.

Germany’s Focus on Efficiency and Flexible Operations

In Germany, the demand for industrial pump rentals is largely driven by the country’s focus on operational efficiency and flexibility. The German market is known for its precision and reliability, qualities that are reflected in its approach to industrial equipment rentals.

The culture of efficiency in Germany affects various industries such as construction, oil & gas, and manufacturing, where pump rentals are essential.

Market Dynamics for Pump Rentals

Germany’s industrial pump rental market has a strong demand for high-quality, reliable pumps that can be integrated into existing systems efficiently. The flexibility to rent equipment instead of buying it outright allows businesses to respond quickly to changing project requirements.

Key factors driving the demand for pump rentals in Germany include:

- The need for efficient operations to stay competitive.

- The ability to scale operations up or down as needed.

- The reliability and quality of rental equipment.

The following table outlines the types of pumps commonly rented in Germany and their applications:

| Type of Pump | Application | Rental Duration |

| Centrifugal Pumps | Water treatment, construction | Short-term, Long-term |

| Submersible Pumps | Dewatering, sewage | Short-term |

| Positive Displacement Pumps | Oil & gas, manufacturing | Long-term |

The focus on efficiency and flexibility in Germany’s industrial pump rental market is expected to continue, driven by technological advancements and the need for adaptable operational strategies.

The future of pump rentals in Germany looks promising, with opportunities for rental service providers to innovate and expand their offerings.

Australia’s Mining Industry Driving Industrial Equipment Rentals

Australia’s mining industry, known for its abundant mineral resources, is driving the growth of industrial equipment rentals. The mining sector plays a crucial role in the country’s economy, and there is an increasing demand for efficient and flexible equipment solutions.

Australia’s mining operations are increasingly reliant on rented equipment

The mining industry in Australia is known for its large and varied mineral deposits, including iron ore, coal, gold, and nickel. To efficiently extract these resources, mining companies are turning to rented industrial equipment, such as pumps, to fulfill their operational requirements.

Pump rentals are especially important in the mining sector for various tasks like dewatering mine sites and managing water resources. The advantage of renting equipment gives mining companies the ability to adjust their operations as necessary, without incurring significant upfront expenses that come with buying equipment.

The shift towards renting industrial equipment, including pumps, is fueled by the need for cost-effectiveness and operational flexibility. Mining companies in Australia are utilizing rental services to access a wide array of equipment, ensuring they can effectively respond to fluctuating market conditions and operational demands.

| Equipment Type | Rental Duration | Primary Use in Mining |

| Centrifugal Pumps | Short-term to Long-term | Dewatering, Water Transfer |

| Submersible Pumps | Short-term | Mine Dewatering, Flood Control |

| Positive Displacement Pumps | Long-term | Slurry Handling, High-Pressure Applications |

The reliance on industrial equipment rentals, particularly pump rentals, is expected to persist as Australia’s mining industry evolves. The ability to rent equipment offers mining companies the flexibility to adapt to changing operational needs and market conditions.

Future Developments in Pump Rental Services

The pump rental services industry is on the verge of a major change, driven by emerging trends and technological advancements.

As the industry continues to grow, several key trends are expected to shape the future of pump rental services. These include the increasing use of digital technologies, such as IoT sensors and data analytics, to enhance equipment monitoring and maintenance.

Emerging Trends and Technologies

Digitalization is transforming the pump rental industry by enabling real-time monitoring, predictive maintenance, and optimized equipment performance. This not only enhances customer satisfaction but also reduces operational costs.

Another significant trend is the growing focus on sustainability and environmental responsibility. Pump rental companies are increasingly being asked to provide more energy-efficient and environmentally friendly solutions, driving innovation in pump design and operation.

Future Pump Rental Services Trends

The integration of artificial intelligence (AI) and machine learning (ML) is also expected to play a crucial role in the future of pump rental services. These technologies can help predict equipment failures, optimize rental durations, and improve overall service delivery.

Furthermore, the rise of modular and portable pump solutions is catering to the increasing demand for flexibility and scalability in various industries, including construction, oil & gas, and mining.

- Increased use of digital technologies for equipment monitoring

- Growing demand for sustainable and energy-efficient solutions

- Integration of AI and ML for predictive maintenance and service optimization

- Rise of modular and portable pump solutions

These emerging trends and technologies are set to redefine the pump rental services landscape, offering new opportunities for growth, innovation, and customer satisfaction.

Competitive Landscape and Service Expansion Strategies

The industrial pump rental market is becoming increasingly competitive, with companies adopting various strategies to expand their services. This shift is driven by the growing demand for pump rentals across industries such as construction, oil & gas, and mining.

Key Players:

-

Action – USA

-

United Rentals – USA

-

Ashtead Group Plc – UK

-

Holland Pump – Netherlands

-

Integrated Pump Rental – USA

-

Barco Pump – USA

-

Thompson Pump – USA

-

Global Pump – USA

-

Xylem – USA

-

Tsurumi – Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Industrial Pump Rental Market |

| Base Year | 2024 |

|

Segment by Type |

· Centrifugal Pumps · Submersible Pumps · Positive Displacement Pumps |

| Segment by Application |

· Construction Industry · Oil & Gas Sector · Mining Industry |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The industrial pump rental market is set for significant growth, driven by increasing demand from various industries such as construction, oil & gas, and mining. As analyzed in the previous sections, the market is expected to hit $44.56 billion by 2025, with the U.S., Germany, and Australia being key contributors to this growth.

A comprehensive industrial pump rental market summary reveals that the trend is driven by the need for flexible and efficient operations. The rising demand for temporary equipment rental services is expected to continue, driven by the need for cost-effective solutions and the increasing complexity of industrial projects.

Looking ahead, the market outlook remains positive, with emerging trends and technologies expected to further drive growth. As the industrial pump rental market continues to evolve, companies will need to adapt to changing customer needs and technological advancements to remain competitive.

Global Industrial Pump Rental Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Industrial Pump Rental Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Industrial Pump Rental MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global Industrial Pump RentalPlayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Industrial Pump Rental Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Industrial Pump Rental Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Industrial Pump Rental Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Industrial Pump Rental MarketInsights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected size of the Industrial Pump Rental Market by 2025?

The Industrial Pump Rental Market is expected to reach $44.56 Billion by 2025.

Which regions are experiencing accelerated growth in the Industrial Pump Rental Market?

The U.S., Germany, and Australia are experiencing accelerated growth in the Industrial Pump Rental Market.

What are the key trends driving the adoption of industrial temporary equipment?

Current market trends, technological advancements, and other factors are contributing to the increased adoption of temporary equipment rental services.

What challenges do rental service providers face in scaling their operations?

Rental service providers face challenges such as overcoming scaling challenges, managing upstream and downstream forces, and adapting to geopolitical factors.

How do geopolitical factors impact equipment deployment in the pump rental sector?

Geopolitical tensions, trade policies, and other related factors influence equipment rental and deployment strategies.

What are the main types of pumps available for rent in the industrial pump rental market?

The main types of pumps available for rent are centrifugal, submersible, and positive displacement pumps.

Which industries are driving the demand for pump rentals?

The construction, oil & gas, and mining industries are driving the demand for pump rentals.

What is driving the demand for pump rentals in the U.S. market?

The demand for pump rentals in the U.S. market is being driven by two main factors: aging infrastructure and the need for emergency response.

How is Germany’s emphasis on efficiency and flexible operations influencing the pump rental market?

Germany’s focus on efficiency and flexible operations is impacting the demand for pump rentals and the strategies used by rental service providers.

What role is Australia’s mining industry playing in driving industrial equipment rentals?

Australia’s mining industry is driving the demand for industrial equipment rentals, including pump rentals.

What emerging trends and technologies are expected to shape the pump rental industry?

Emerging trends and technologies, including innovations in pump rental services, are expected to shape the industry.

What strategies are companies adopting to expand their services in the competitive industrial pump rental market?

Companies are adopting strategies such as service expansion and competitive analysis to grow in the market.